The market, ASX 200 (XJO) hit a post-covid high of over 6,500 yesterday and ended the day just under it.

In the last 48 hours markets globally have seen a positive uplift, mainly due the news of a second vaccine from Moderna that is claimed to be 95% effective as opposed to Pfizer’s claims for their vaccine last week.

Pfizer’s vaccine headlines were also accompanied by the CEO selling 7.5 million AUD worth of shares on the same day the vaccine effectiveness was released to the media and the share price rose 15%. Made us raise our eyebrows and think of our article on Director’s buying and selling shares just 2 weeks ago.

Other highlights of note to markets:

- Australia signed the world’s biggest trade deal RCEP (Regional Comprehensive Economic Partnership)

- NSW plans to make stamp duty optional. A land tax instead.

- Australia’s travel bubble plans with NZ on hold with new outbreak of cases in South Australia

- US now has 11.2million cases of covid, and is on a trajectory that will top 200,000 new cases daily by the end of November. France has gone over 2million cases

- Thousands of people volunteer to take test cruise ship trips as operators look to satisfy CDC standards for being COVID safe.

- US election uncertainty seems to be subsiding.

- Rotation into Energy, Travel and Leisure, cyclical companies continues for now, but at a slower pace.

We’re keeping a close eye on things and looking at companies that will become ideal to take positions in, both from our existing portfolio and our watchlist.

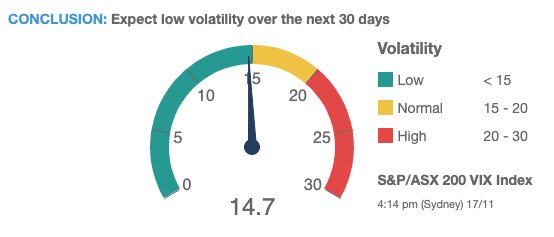

The VIX (volatility index) has dropped even further.

Volatility has been levelling out the last few months and has now sharply dropped.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The VIX reading is under 15 points at COB yesterday.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

16th Nov, Monday’s ASX “crash”

When we wrote ‘Will there be another share market crash in 2020’, we didn’t think it would the kind that had the ASX tech support team putting out fires.

Monday’s ASX outage which started around 10.30am, lasted for hours before the market was officially closed to investigate and fix an issue with a system upgrade of the data trading system, which was implemented by NASDAQ.

And it was specifically due to to do with combination trading of equities, and options (CX trades). This type of combination trading has been disabled and the ASX resumed trading the next day.

ASX released an official apology and response late on Monday.

They’ve only been a few instances of the ASX having technical issues and having to shut down trading. Yesterday’s 6.6 hour outage was the longest the market has been shut in 10 years. Reports say that the impact of no trading yesterday, across 2000 listed companies and institutional money etc. totals about 1.2. trillion AUD.

It hasn’t been a great quarter for the ASX, a publicly listed company itself. Last month the ASX’s much-anticipated new website failed shortly after launch, blocking access to company announcements and market data leading to criticism of the ASX being the only exchange in Australia.

Many other countries have multiple exchanges which lends itself two more providers competing for providing the service, generally a good thing.

Are tech issues on the ASX a concern and are shareholdings safe?

Without getting into too much detail, the short answer is that we are very fortunate with the way ASIC and the ASX work, the regulations around ownership and trading of shares, being linked to a CHESS / HIN number that is unique to each shareholder. And with registries like Computershare to manage share holdings and brokers, shareholder’s actual ownership of shares is always safe and therefore the value of money is safe in them. There’s always going to be a track record and history of what trades were done with the ASX.

The other reason we feel safe, is that we use brokers like SelfWealth who allow you to buy shares with your own CHESS / HIN that’s connected to your Tax File Number.

With some of the other brokers including new ones like SuperHero, this is not the case. You do not technically own the shares because they trade all the shares on your behalf, under their own CHESS / HIN which means they technically own the shares. Of course, it’s up to everyone to decide whether cheap brokerage is worth the technical ownership issue. We’ve never used brokers that don’t allow us to trade with our individual CHESS / HIN, thereby ensuring the shares are actually owned by us.

Thoughts on Tabarruk’s portfolio value crossing 250k

We’re at 115% growth with our portfolio and the core of our long term strategy has been:

1️⃣. Investing in established businesses

2️⃣. Finding smaller companies or business recovery signs early

3️⃣. Conviction and patience to hold as growth occurs

4️⃣. Using our secret to buying at the bottom

5️⃣. Investing a portion of our income monthly or fortnightly

Since the start of our portfolio in March 2020, once our initial investment had grown to a baseline of what we felt was ‘secure’ we diversified into some early picks and companies that were recovering. This theme is something that we continue to do while researching companies and sectors, week in, week out.

This has had our portfolio rally to new highs off late as the rest of the market and media got wind of some of these sectors and companies.

This combination really comes into its own when you have multiple early finds, combined with the holdings in established companies also growing at a good rate. Finding companies early can be life changing.

Watchlist and portfolio updates for members are at the bottom of this update.

On to the latest CEO insights.

CEO Insights by Sector

Workplace & Employment

“We believe the shift to distributed work will continue long after the pandemic ends”

Drew Houston, CEO, Dropbox Inc

“We’re expecting, hoping it [unemployment] will get to 6.5 per cent by the end of calendar year 2021, I think that would be a very, very good result”

Matt Comyn, CEO, Commonwealth Bank of Australia Ltd

Domestic Economy

“Some of the underlying impact of lockdowns we probably can’t quite see until probably April/June quarter next year”

Matt Comyn, CEO, Commonwealth Bank of Australia Ltd

“Australia is positioned to demonstrate to others the importance of investing in relationships and the power of trade. We have demonstrated for decades a firm belief in cooperation and collaboration in our region and beyond. The Australian Government’s leadership together with China and other nations to finalise RCEP is such an example. We must return the world to growth to help improve living standards and do it in a way that is sustainable and benefits all. For us to ‘build back better’, we must ‘build back better, together’ … we have to ensure we are doing absolutely everything in our power to secure Australia’s continued prosperity through mutually beneficial trade and co-operation”

Mike Henry, CEO, BHP

Chinese Economy

“This was another extraordinary quarter for Chinese consumer consumption”

Fabrizio Freda, CEO, The Estée Lauder Companies Inc

Food & Beverage

“Despite restricted operating conditions due to a virus resurgence in the State of Victoria, strong drive-thru and delivery sales drove roughly 75% of Australia sales, and they grew market share. Australia has also seen an increase in other digital channels, such as our mobile app and self-order kiosks, as customers use contactless ways to order and pay”

Kevin Ozan, CEO, McDonald’s Corp

Agriculture

“Milk supply in Australia continues to improve…Favourable weather conditions have helped increase milk production for our current base of suppliers. We’ve seen increased milk purchases from third-party milk brokers, and we continue to increase our toll manufacturing opportunities. Volumes are performing better than prior year”

Kai Bockmann, COO, Saputo Inc [Australia’s largest dairy processor]

“There were reports just a few weeks ago about rain and hail storms and the damage they had done to crops, put simply we’re not seeing the impact of that coming through our network based on the scale of the crop”

Robert Spurway, CEO, GrainCorp Ltd

“Right now, we’re into harvest and we’re seeing what’s happening and we’re very confident about the amount of grain coming into our network, based on what we see as a very significant crop across East Coast Australia. We’ve seen good yields. We’ve seen good quality”

Robert Spurway, CEO, GrainCorp Ltd

Domestic Retail

“With borders reopening and the return of domestic tourism, along with a steady increase in workers returning to CBD offices, this should support improved retail conditions across Australia”

Grant Kelley, CEO, Vicinity Centres

“As a result of significant pent-up demand, the trading performance across stores in Melbourne has been very strong since they re-opened to retail customers on 28 October 2020”

Rob Scott, CEO, Wesfarmers Ltd

Media & Advertising

“Since the end of September, the FTA [free to air] advertising market and Nine’s share of that market, have both improved significantly”

Hugh Marks, CEO, Nine Entertainment Co Holdings Ltd

Construction & Infrastructure

“As we look ahead, our customers are pointing to volumes remaining at current levels through to the start of the new calendar year”

Ross Taylor, CEO, Fletcher Building Group Ltd

Energy & Resources

“After scientific and personal analysis of the renewable resources of our little planet I can assure you there is more than enough renewable energy to sustainably and economically supply every person on the planet from this time forth”

Andrew Forrest, Chairman, Fortescue Metals Group.

Commercial Property

“Vacancy is beginning to rise and it’s beginning to rise fairly quickly now which is again exactly what you would expect in a downturn of this sort. Companies that do not have the ability anymore to kick the can down the road are, based on our numbers renewing and that’s at a higher percentage than is typical. They’re not going to the market. They’re just going to renew and they’re renewing at shorter-term leases”

Brett White, CEO, Cushman & Wakefield plc

“At the moment, the way I would describe, what we’re seeing on the leasing side is rents are holding up. That will change. We know the rents are going to be coming down”

Brett White, CEO, Cushman & Wakefield plc

“Rising confidence will combine with very low interest rates to drive investor capital toward property, and particularly commercial property yielding two to three times the yield available from buying residential”

David Harrison, CEO, Charter Hall

Aviation

“There’s reasonable optimism now that [northern hemisphere] summer 2021 will get back to some degree of normality”

Michael O’Leary, CEO, Ryanair

Automotive

“We are now assuming a global car demand down 17% for the full year, 2 percentage points better than our previous expectations, and a minus 5% in the fourth quarter. High-value [car industry] is confirming its resilience”

Andrea Casaluci, CEO, Pirelli Tyre & Co SpA

Tourism & Leisure

“Caravan sales are very strong at the moment – a six month wait for a new caravan is not unusual – and the two most popular regions in Australia for caravanning and camping are the NSW North Coast and NSW South Coast”

Simon Owen, CEO, Ingenia Communities Group

Members only updates follow below.