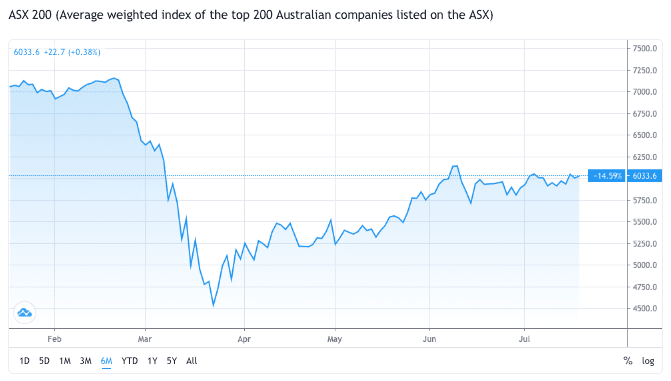

There is a growing apathy in the share market. The ASX 200 (Average weighted index of the top 200 Australian companies listed on the ASX), is struggling to make any meaningful breakthrough the 6000 points psychological barrier.

Crash or correction? What is the difference?

Technically the definition is a downward movement of 10% or under is considered a correction and anything larger and leading to a prolonged period of economic hardship is considered a crash.

For us, there isn’t a big difference. It could be argued we’re still in the process of recovering from a crash. Some sectors have recovered more than others.

Members can read on to see what we think is likely to happen.

I am convinced that we are looking at another correction taking place within before the year ends.

Looking at some of the companies currently trading at insane premiums, it makes us wonder how long this run can be sustained. We’re optimistic pessimists when it comes to the share market and understand the role of fear and greed in this context. The more understated, but impactful emotion though, is hope. A base built on hope is very shaky, which is the main underlying sentiment driving the influx of retail investors (a non-professional individual investor) into the ASX.

We’re passionate about education and try to explain to readers and members why a correction is not a bad thing and the factors that would lead to the correction. We also educate people on identifying the tell-tale signs so they can become astute investors.

Crash or corrections are buying opportunities

This is because an investor is always on the lookout for buying shares in companies that are trading at a discount, in comparison to their fair value.

What this does is create a scenario over the next few months, where we approach the end of a mini recovery (aka bull run). Corrections like the word implies is a reality-check to a share market flooded with retail investors due to the “fear of missing out” (FOMO). This inevitable results in money being flooded into the market and inflate stock prices to trade at premiums that do not reflect the fundamental reality of a companies prospects and financial balance sheet. Another way to look at this is, more demand = price increase.

We often get asked, if everyone is buying, why would the market correct itself? Shouldn’t it keep increasing?

The role large investors play in corrections

This is where large corporations and institutional funds come into play. Think banks, super funds and other large financial organisations with money to invest.

Let’s take a popular company that gets invested in by retail and large investors, BHP. Over 60% of the company is owned by major entities like HSBC, JP Morgan, Citicorp, BNP Paribas etc.

What happens when they want to realise profits and think prices for BHP are inflated? They sell BHP shares. For large investors, they will be substantial amounts of shares.

What happens when these shares get sold in large volumes? More supply = price drops.

Now think about what retail investors, like you or me would instinctively do? What would the everyday Mum and Dad investors do when they see large amounts of shares being sold? They might panic and think, the price is dropping, maybe something is wrong and also join in the selling. This triggers a price to decline over a period of weeks.

Now multiply it with the strategy of large institutions, who are active investors, they’re looking to sell high (and keep selling even if the price drops a little). What they’re looking to do next is sometimes not obvious until it’s too late. They are waiting to buy back the same shares at even lower prices that inevitable some retail investors will end up selling.

A sobering reality is that approximately 30% of the global share market is owned by large funds and institutional investors. 50% by government, pensions and corporations. That makes up 80%. The remaining 20% is us, retail investors.

The other kicker is that the large institutions use other people’s money and by deciding to sell shares at volumes, the market experiences enough of a downward pressure which leads to corrections. Retail investors often follow like a herd.

These same institutions then picking up the stocks at the bottom after a few weeks or months. On average a correction lasts two months.

So how can we as retail investors, make money?

When the odds are stacked against you, you keep it simple.

You play the long game.

Watch, understand the market and the companies. Look for buying opportunities or invest regularly in the same companies, so your average price ends up being discounted.

Finally, we’re not in the game of making grand, fluffy predictions at Tabarruk. We do make educated estimates of the probability of certain movements in the market. We look at all the facts, analyse macro-economic indicators and have a plan to act on, regardless of the market moving up or down.

fahd

fahd