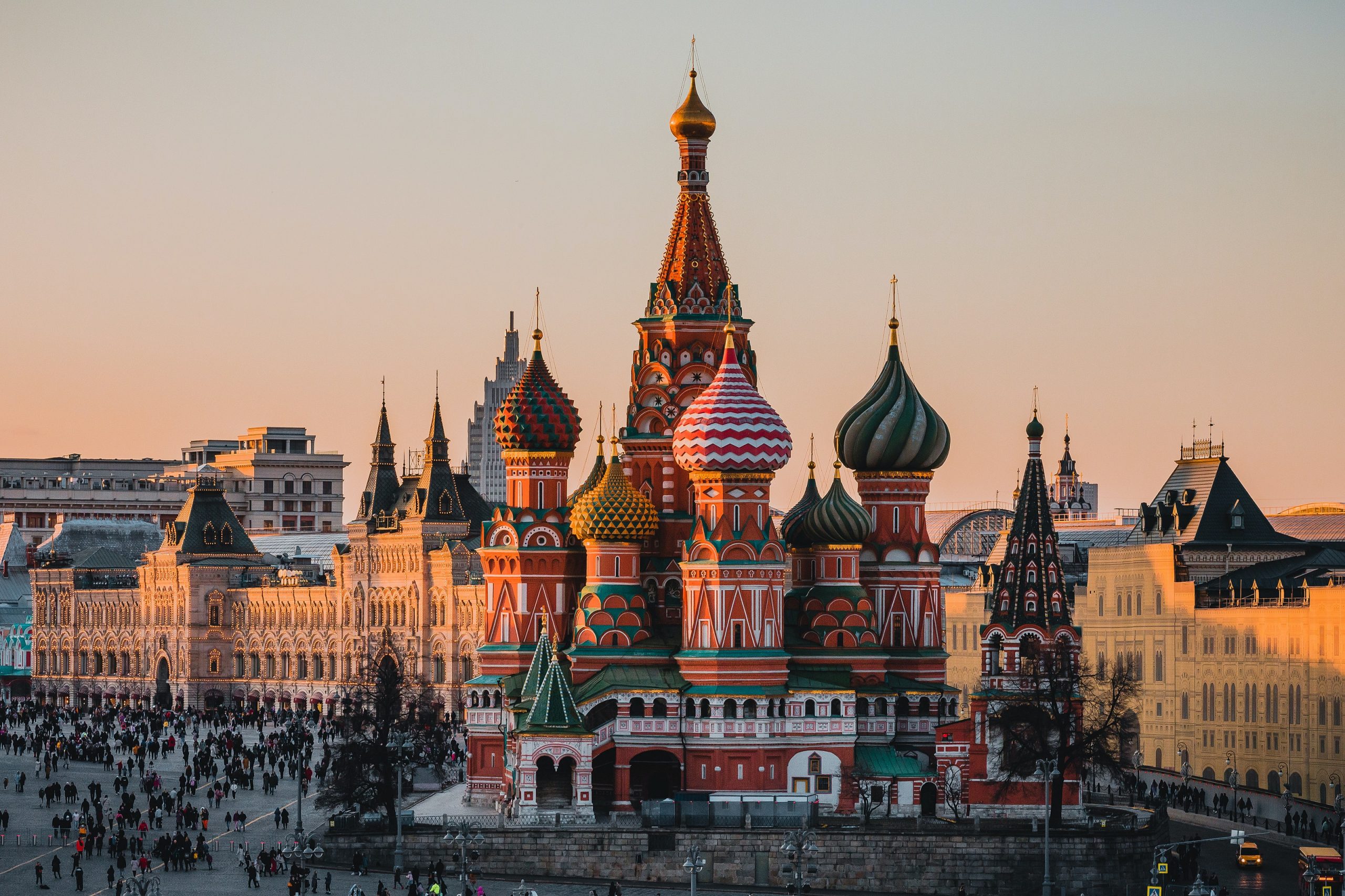

Since our last update, the markets have been volatile, mainly due to the Russia-Ukraine tensions and inflation / rate rises. The Australian market seems mostly unaffected in comparison to the US. The NASDAQ fell almost 10% in the last 10 days and is almost 20% down since the November 2021 highs.

The ASX 200 (XJO) is hanging on around the 7,000 level, down only 1.14% in the last 10 days and 5.6% down from the November highs.

BREAKING: Reports of military strikes are just coming out in Ukraine. ASX is down 3% and US Futures are down 2%.

Companies continue with releasing quarterly updates.

The likely market correction we spoke about previously based on technical analysis seems to be continuing. It is not one to be alarmed about for long term investors. They are healthy and return markets back to fair valuations and provide buying opportunities.

The ASX VIX (volatility index) has finished the month higher at 19.3.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

CEO Insights

Telecommunications

“The last two years have shown us the criticality of communications [and] the demand for network quality has only increased”

Andy Penn, CEO, Telstra Corporation Ltd

Labour Markets & Workplace

“Businesses continued to rehire following COVID-related cuts, and in many cases restarted investment. Whilst candidate activity on our sites remained high, application rates were weaker”

Ian Narev, CEO, Seek Ltd

Metals & Resources

“The global decarbonisation of steel making, and electricity generation industries is driving demand for recycled metal”

Market Statement, Sims Ltd

“Coal supply is very constrained in all jurisdictions across the world and coal demand is very strong. We see this continuing for some time”

Paul Flynn, CEO, Whitehaven Coal Ltd

Inrastructure & Construction

“New major projects remain slow to move into execution, despite the sizeable infrastructure pipeline”

Zlatko Todorcevski, CEO, Boral Ltd

“We see now that the boost for our sector will expand longer and higher than just a one-for-one compensation of the [COVID] dip, because of savings redirected to renovation because of stimulus plans”

Guillaume Texier, CEO, Rexel S.A. [major multinational electrical supplies distributor]

“This [construction demand] is anecdotally supported by our home builder customers generally now placing orders for their customers 12 to 18 months in advance”

Ross Taylor, CEO, Fletcher Building Ltd

Domestic Economy

“We certainly haven’t seen the inflation [in Australia] that we’ve seen in North America”

Brian Lowe, CEO, Orora Packaging Ltd

“The impact [of Omicron] has moderated in February”

Market Announcement, Cleanaway Waste Management Ltd

Macroeconomic

“I do think we need to front-load more of our planned removal of accommodation than we would have previously. We’ve been surprised to the upside on inflation. This is a lot of inflation”

James Bullard, Board Member, US Federal Reserve

Defence Spending

“The trend is continuing when it comes to the defence budgets [globally], they are increasing all over the place”

Micael Johansson, CEO, Saab AB

Agriculture & Farming

“When things are good, you’ll find that farmers are looking to increase their assets and they’re buying more land and putting their cash into machinery”

Marnie Baker, CEO, Bendigo & Adelaide Bank Ltd

E-commerce

“We believe that the COVID-triggered acceleration of ecommerce that spilled into the first half of 2021 in the form of lockdowns and government stimulus will be absent from 2022”

Amy Shapero, CFO, Shopify Inc

Sport & Lifestyle

“I believe that currently, the inventory levels in the channel are probably the healthiest they’ve been [for the sector] in the last decade”

Patrik Frisk, CEO, Under Armour Inc

“These structural shifts [behind golf market growth] include what we believe are long-term increases in remote and hybrid work, the increased desire to get out into nature, the momentum behind casual lifestyle apparel brands, the growth of new golfers with waiting lists to get into golf courses, and the growth and positive impact of off-course golf”

Chip Brewer, CEO, Callaway Golf Co

Retail

“Our tenant sales are now approaching pre-pandemic levels globally while traffic levels are evolving positively“

Jean-Marie Tritant, CEO, Unibail-Rodamco-Westfield SE

“Travel retail has experienced a significant rebound but is still far from the pre-pandemic levels”

Nicolas Hieronimus, CEO, L’Oréal S.A.

“Retail trading conditions were subdued in January due to rising cases of the COVID-19 Omicron variant impacting both customer traffic and labour availability, but trading momentum has improved in recent weeks”

Market Announcement, Wesfarmers Limited

More updates and video on market and portfolio companies for members follow below.