After a high in November, the market had a small pullback before starting December steadily in the green.

There is a new picture emerging when comparing global economies. Our employment and GDP numbers show we’re not on the brink of recession and recovering rather well. The US on the other hand, has 10 million people out of work, a long wait on vaccines, questions on further stimulus, all leading to a limping economy.

The contrast is even greater with the COVID situation. Over 2500 deaths a day (that’s a death every minute) and 200,000 new cases daily in the US. Zero deaths for some time now in Australia and a handful of cases, mostly from people flying in.

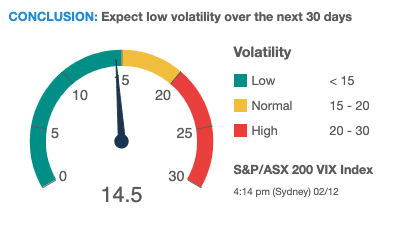

The ASX VIX (volatility index) remains in a slow downward trend.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The VIX reading is under 15 points at COB yesterday.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

On to the latest CEO insights.

CEO Insights by Sector

Banking & Payments

“So there has been a run on cash in every central bank in the world in the pandemic. I mean there isn’t a single bank in the world that hasn’t seen increased demand for cash”

Geoffrey Martin, CEO, CCL Industries Inc [world’s largest diversified label company & banknote maker]

“There is a lot of interest in polymer [bank] notes and I would say that it’s accelerated during the pandemic because people are worried about the cleanliness of [paper] currency as well as the cost efficiency and all the other aspects of it. So, we’ve got a lot of interest in that field”

Technology

“We’re seeing such trends and such tailwinds around streaming, whether it be audio or video and that plays right into what we’re doing”

Patrick Spence, CEO, Sonos

“COVID has resulted in the acceleration of technology in every aspect of our lives and there will be no turning back. This is a fundamental shift”

Frank Calabria, CEO, Origin Energy

Tourism & Leisure

“Regional tourism is very, very strong. Holiday parks with their open space make social distancing very easy to do. This has been a real positive for the whole industry”

Grant Wilckens, CEO, G’Day Parks [Australia’s largest holiday/caravan park owner and operator]

“If you said tomorrow that there was a vaccine with 100 per cent efficacy, and everyone gets it, do people want to live on a cul-de-sac or in a city? They’d rush back and realise there was a reason they weren’t living in a cul-de-sac before”

Peter Kern, CEO, Expedia Group

“We’re seeing extremely strong demand in the back half of fiscal-year ’21 and all of ’22 in terms of cruise line bookings”

Bob Chapek, CEO, The Walt Disney Company

Workplace & Employment

“My prediction would be that over 50% of business travel and over 30% of days in the office will go away”

Bill Gates, Co-Founder, Microsoft Corp

“At the beginning of the pandemic, we heard an awful lot about how effective it is using technology to work from home…But what we’re also hearing now is how important it is to be in the office for creativity, the team working, the projects for coaching and development” Dominic Blakemore, CEO, Compass Group PLC [world’s largest contract food service company]

Residential Property

“With the scheduled end of the Job Keeper and deferred mortgage programs still yet to be determined, along with other macro factors impacting consumer confidence, there is still material uncertainty as to whether the momentum evidenced in the first half of FY21 will be maintained in the second half results”

Eddie Law, CEO, McGrath Ltd

“The major lenders have seized the opportunities presented by favourable funding conditions and have aggressively targeted market share growth with generous cash back offers and very competitive fixed rates for new customers. This has seen the major lenders regain market share from the non-majors. They now hold 60.1% of the market, up from circa 52% in the same period last year”

David Bailey, CEO, Australian Finance Group [AFG] Ltd

Building & Construction

“Demand strength [from the construction industry], particularly in the Australian market, has continued to outpace our expectation”

Mark Vassella, CEO, BlueScope Steel Ltd

Transport & Logistics

“Despite the fact that we are still in the middle of the pandemic with continued high uncertainties, we have seen a strong recovery in demand within transportation and logistics, which has led to equipment shortages, both containers and vessels”

Søren Skou, CEO, Maersk [global shipping company]

Advertising & Marketing

“Millennials and Gen Z are hard to reach. The traditional modes of advertising don’t reach this generation”

Anthony Eisen, Co-CEO, Afterpay Ltd

Retail

“I do think that some personal [shopping] habits will have changed on a relatively permanent basis in terms of customers focus on handwashing and overall safer lifestyle choices when it comes to keeping clean go forward”

Andrew Meslow, CEO, L Brands Inc [global clothing, soap & fragrance conglomerate]

Food & Beverage

“I think we are at the very beginning, for meat and dairy substitutes, of their market growth – they are still tiny compared to the overall meat and dairy markets. In the most developed countries, it’s 5%of meat or dairy – some predictions say it could go to 50%.”

Hanneke Faber, President, Foods & Refreshment, Unilever

“Long before the pandemic started, we were witnessing a shift away from the traditional sit-down family dinner. Anyone who has kids has experienced this. Many activities, not enough time and dinner was whatever could be eaten between activities. The pandemic brought the sit-down family dinner back. Meals previously eaten on the go have become family activities”

Jim Snee, CEO, Hormel Foods Corporation [multinational processed foods conglomerate]

Aviation

“The history books will record 2020 as the industry’s worst financial year, bar none. Airlines cut expenses by an average of a billion dollars a day over 2020 and will still rack up unprecedented losses”

Alexandre de Juniac, CEO, International Air Transport Association [IATA]

“[A lack of national cohesion on borders] Is kryptonite for the tourism industry. No one knows what is going to happen from one day to the next”

Geoff Culbert, Chief Executive Officer, Sydney Airport Ltd

Energy & Resources

“Renewables are plunging in cost so fast, gas will never get a look in. This isn’t about politics. It’s about economics and realism”

Mike Cannon-Brookes, Co-CEO, Atlassian Inc

Chinese Economy

“If you look at China right now where things are pretty much back to normal, you will see our businesses are performing well there, people are socializing outside the home again”

Ivan Menezes, CEO, Diageo PLC [multinational alcohol company]

On to purchase entries and company updates for members.