The market, ASX 200 (XJO) hit a high of 6,437 this morning and is sitting at 6,351 at 2.22pm.

Overnight, Pfizer released a media statement claiming that their vaccine is 90% effective.

This combined with increasing certainty following the US elections caused a significant rally on global stock markets, so it was inevitable that the ASX would follow.

As we saw in April 2020, when the media put out initial ‘recovery / vaccine’ hopes, the sectors and companies that the money has flown into today, and caused surges in share prices were Energy, Travel and Leisure.

Whether the Pfizer vaccine is indeed effective and how long it would take to get to the masses, remains to be seen. Likewise, the rotation of investors attention from Technology and Health into ‘recovery’ plays is also something that needs time to ascertain if it’s temporary or longer term.

Some key highlights we’ve noted:

- Global coronavirus cases go over 50 million as USA and Europe have difficulty containing surges

- China state media takes an optimistic tone on Biden, says relations could be restored to a state of greater predictability

- China auto sales go from strength to strength as virus recedes; optimism growing that slump is over; electric cars gain ground

- Business sentiment of Japanese manufacturers and service-sector firms was the least pessimistic in nine months in November

- IEA sees new European lockdowns denting oil demand outlook, but would likely be less severe than under lockdowns earlier in the year

- International travel into and out of Australia not officially open but sentiment around it seems to be changing

Regardless, we’re keeping a close eye on things and looking at companies that will become ideal to take positions in, both from our existing portfolio and our watchlist.

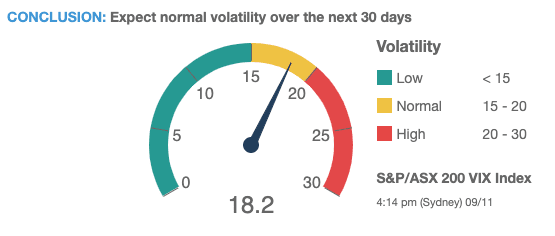

Also interesting to see the VIX (volatility index) has dropped from the elevated levels the last couple of weeks, as we highlighted in our ASX vs global markets and volatility article.

As you can see, the volatility spiked to a peak around the March covid crash before levelling out over the next few months. There was a clear uptrend forming from the last 2 week period which is now starting to settle down again.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

Today’s VIX reading is around 18 points.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

Watchlist and company updates for members are at the end of this post.

On to the latest CEO insights.

CEO Insights

Retail & E-Commerce

“What we saw in the second quarter, clearly a significant disruption in a lot of areas and scarcity in certain areas in the supply chain and distribution that drove a lot of people shopping online…What we’ve seen in the third is it’s reverting to a more normalised buyer acquisition trend and more normalised repurchase frequency for those cohorts”

Andy Cring, CFO, eBay Inc

“These [recent e-commerce ASX listing] companies have…taken advantage of good market conditions, but this is the next generation of retail. You can’t put the genie back in the bottle”

Mark Coulter, CEO, Temple & Webster Ltd

“We’re seeing more customers than ever shopping early for their holiday gifts, which is just one of the signs that this is going to be an unprecedented holiday season”

Jeff Bezos, CEO, Amazon Inc

“As we look into the future, there’s no difference between a micro [SME] business and an online micro business. Every micro business is going to be online. That’s just how people are going to find things. That’s just how people are going to want to transact, because it’s going to be simpler for them and it will allow them to scale in a way that previously they couldn’t”

Aman Bhutani, CEO, GoDaddy Inc [worlds’ largest domain/website hosting company]

Consumables, Meat & Livestock

“COVID has been the greatest sales changer that anyone has ever seen. When you have five million people locked in their homes or a panic attack across the whole country, that drives sales more than any other promotional event”

Steven Cain, Chief Executive Offer, Coles Group Ltd

“We see incredible opportunities, quite frankly, across the mega trends all over the world that we’re seeing on the ground. Naturals and sustainability, the urbanisation that we’re seeing in big markets, ageing population in developed markets, or younger population and per capita consumption opportunities in developing countries”

Noel Wallace, CEO, Colgate-Palmolive Company

“Never in my lifetime have we seen the dearest cattle in the world in Australia”

Peter Hughes, Owner, Hughes Pastoral Company [major QLD cattle group/landowner]

“Values being paid for young grower or replacement cattle bear no reflection to the current domestic or global meat market and are more a reflection of the desire for producers to restock their properties that have experienced a great season following the drought”

Trevor Lee, Owner, Australian Country Choice [major cattle group/landowner]

Residential Property

“We continue to see our customers invest more in the comfort of their homes, where many are spending more time working and studying”

Mark Ronan, CEO, Adairs Ltd

“We have quite an optimistic outlook on what’s going on around Australia”

Mike Schneider, MD, Bunnings Group.

Travel & Leisure

“We were really quite surprised by the level of demand that came into the product of the winter season. Within the first two weeks, we had literally triple the demand that we were expecting at rates above what we were expecting”

Michael Bayley, CEO, Royal Caribbean International

“I’d have to say it’s [length of rental] pretty elevated. Our customers are keeping the cars longer so when I say that people are checking out at weekends, it’s not like a weekend rental. It’s like you think where you’d take out Friday and come back Sunday, it’s not that at all. They’re using the car over these longer leisure periods”

Joe Ferraro, CEO, Avis Budget Group, Inc

“There’s much discovery going on and price shopping and there seems to be more direct bookings in the smaller market independent hotels as people are calling to make sure they’re open, make sure that safety protocols, etc”

Peter Kern, CEO, Expedia Group Inc

“The recovery for travel is not going to be in quarters. It’s going to be in years”

Glenn Fogel, CEO, Booking.com Holdings

“There’s a huge amount of pent-up demand. People love traveling, they want to get out, and, by the way, even business travel. People like business travel. It’s a break from the monotony, in some cases, of their work”

Chris Nassetta, CEO, Hilton Hotels

Aviation

“We’re seeing encouraging industry data validating the safety of air travel. Recently, IATA [International Air Transport Association] published data outlining that of the over 1 billion people who have travelled by air this year, there have been fewer than 50 documented cases of transmission”

David Calhoun, CEO, The Boeing Company

“We believe there will be pressure on defence spending as a result of all the COVID-related spending that governments around the world have been experiencing. I don’t think we’re looking at that world through rose-coloured glasses. I expect real pressure on that market”

“The last thing that businesses in any sector needs right now is more red tape, taking time and energy when we should be focused on recovery”

Alan Joyce, CEO, Qantas Airways Ltd

Automotive, Transport & Logistics

“With new car sales returning to pre-pandemic levels in September and dealer inventory more than 20% below average, we’re likely to see continued strength in OE [original equipment sales] demand throughout the remainder of the year”

Rich Kramer, CEO, The Goodyear Tyre & Rubber Company

“Industry conditions improved meaningfully compared to the second quarter and much faster than we expected…Miles driven trends improved globally as freight volumes benefitted from increased consumer and industrial activity”

“All of our plants are now back up and running…and really, most of them now have returned to what I would call near pre-pandemic production levels”

Mike Manley, CEO, Fiat Chrysler Automobiles N.V.

Payments & Lending

“The trajectory of the recovery, where borders are now open provide some indication of how fast the cross-border business could rebound once most borders reopen”

Vasant Prabhu, CFO, Visa Inc

“As a result of the overwhelming government support and our ability to manage at a granular level, so far, the [loan default levels] outcome is better than many feared. In a time of ultralow interest rates, time is cheaper than at any time in our history and so buying time through a deferral can be a very rational response for customers”

Shayne Elliot, CEO, Australia and New Zealand Banking Group Ltd

“We saw [credit] card balances decline a lot and then plateau. We’re still seeing that plateauing effect. I think it will take some time for balances to recover”

Jes Staley, CEO, Barclays

Insurance

“Insurers have continued to increase premium rates, and volumes have held firm”

Robert Kelly, CEO, Steadfast Group Ltd

Technology

“The next decade of economic performance for every business will be defined by the speed of their digital transformation”

Satya Nadella, CEO, Microsoft Corporation

“I look at companies like Microsoft or Amazon and those businesses are the railways of the current era. When railways opened it liberated economies right around the world. What you have with those hyper cloud vendors [eg Microsoft Azure or Amazon AWS], they are the railways of the current era”

Tony Walls, CEO, Objective Corporation

Energy, Mining & Resources

“We are excited to see recent reinvestment into our sector with major mining houses flagging increased exploration spend and junior miners now accessing capital through equity raisings”

Jeff Olsen, CEO, Boart Longyear Ltd

“If all the pledges of the Paris Climate Agreement were met, oil and gas would still be 46% of the energy mix in 2040. The energy transition will take time and major breakthroughs in technology will be needed”

John Hess, CEO, Hess Corporation [global oil & gas producer/refiner]

“Investment in our industry tends to be global and capital will shift to the best place, so governments are aware if they get that wrong through heavy handed intervention, they can actually shift the investment elsewhere and have a negative price impact”

Lawrie Tremaine, CFO, Origin Energy Ltd

Domestic Economy

“Interest rates will rise but it’s hard to know exactly when, I think we have to be sufficiently optimistic that it will occur sometime in the next five years”

Dr Phillip Lowe, Governor, Reserve Bank of Australia

“There has been a modest deterioration in our economic assumptions, the expected shape of the recovery and downturn has changed, with a deeper trough and a slower recovery”

Gary Lennon, CFO, National Australia Bank Ltd

“Anything that helps consumers feel more certain about spending in this important quarter will help propel the retail economy forward – which in turn creates a positive ripple effect on jobs and growth”

Paul Zahra, CEO, Australian Retailers Association

Chinese Economy

“China’s economy is running. We are developing projects, it’s played back to normal and the pandemic seems to be very, very well controlled”

Bertrand Camus, CEO, Suez SA [global waste management/recycling company]

“According to the preliminary data, global chemical production was slightly positive in Q3 2020 compared with the prior year quarter. The resilience of chemical demand in some highly relevant customer industries is one reason for that. Another reason is China. The country continues its V-shaped recovery”

Martin Brudermuller, CEO, BASF SE [world’s largest chemical manufacturing company]

Fitness & Recreation

“We do see strength across categories, basically everything that involves adventure and outdoor activity, especially golf.”

Cliff Pemble, CEO, Garmin Ltd

Members only updates follow below.