$45k now worth over $100k

Fahd and I put a big chunk of our savings, about $45,000 AUD, into the share market in March and April. Today it’s doubled and is still growing! I share what we did and exactly how the last 2 and half months unfolded.

The ongoing financial crisis had markets hit bottom on the 23rd March 2020, and is proving to be worse than the global financial crisis in 2008 and perhaps even the 1920s great depression. These crashes are a once-or-twice in a lifetime opportunity to multiply wealth.

How it all started

Fahd and I met as kids 25 years ago in the Middle East. Our fathers worked together in an Islamic bank. We reconnected again in Australia while studying and found common interests in cricket and Islamic investing. Fahd had followed his dad by becoming a savvy investment analyst. I kept investing on the side, as my father had taught me, but forged a successful career in IT.

Our passion for ethical investing, often had us answering questions to help friends and family get similar results. This led us to launch Tabarruk, where anyone can learn how to grow wealth. We focus on buying sharia-compliant shares in Australian companies listed on the ASX share market.

The COVID-19 crash

Fahd had sold his entire portfolio of shares in January 2020 for a good profit, partly because he felt the market was overvalued and partly out of instinct that something didn’t feel right. I had my money tied up elsewhere and was waiting to get back into the share market.

When COVID-19 started, fear crept into the economy and panic selling ensued on global share markets including the ASX. Fahd and I were calm and objective, applying everything we had learnt over the years. Most of our purchases ended up being on the 23rd of March, the absolute bottom so far. We didn’t predict it. We were simply prepared for the market to go up or down, and had a clear strategy to execute in either scenario.

The 5 strategies we used during the crash

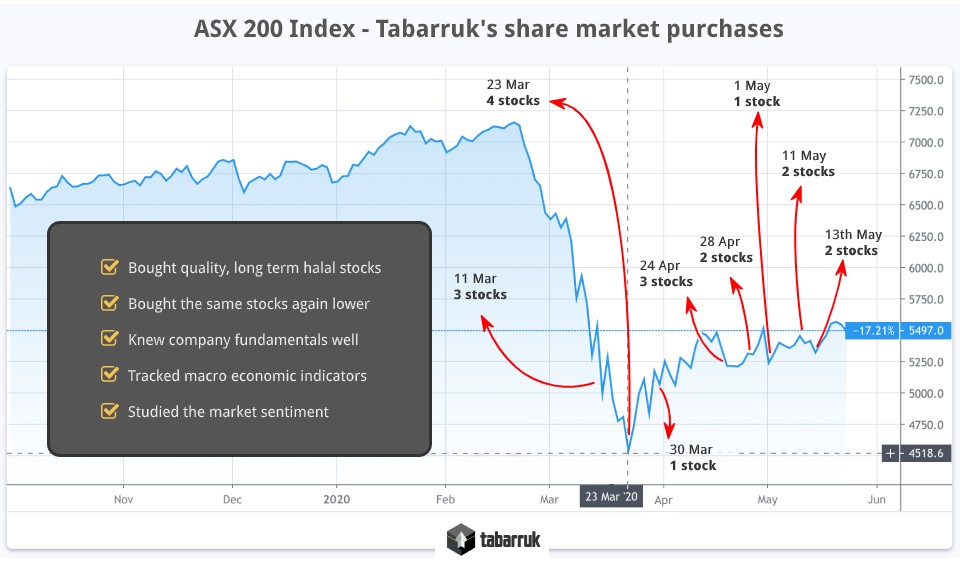

The infographic below shows the Australian sharemarket weighted index chart, pinpoints when we bought shares using our 5 key strategies for investing:

Our key strategy as shown above is the following 5 points:

- Buying quality, long term, ethical company shares

- Buying the same company shares if they dropped in price

- In-depth analysis of company fundamentals and financial reports

- Tracking macro-economic indicators like unemployment etc.

- Studying the market sentiment

Our home page has a summarised table showing the totals of our folio live. Members can see the entire folio live with each company stock with our analysis, purchase dates and prices.

The proof for those who need to see it

We’ve had people ask for screenshots. We’re happy to share, as we’re all about transparency. On request, we can also provide CHESS / HIN statements.

Here is my online broker screenshot as of 23rd May 2020.

And here is Fahd’s screenshot from his broker account as of 23rd May 2020.

Whats next? Is it too late? Absolutely Not!

The next 3-6 month period is an even more important phase of this crash. It’s a rare opportunity to invest in the best ethical companies in the right sectors on the ASX.

The 5 key strategies we used above continue to apply. Some additional criteria may be needed, depending on the change in circumstances or the specific companies we analyse.

Of course, you would have to get set up by knowing where and how you can start buying shares in Australia on the ASX sharemarket. With our referral link, you can get your first 5 share trades for free.

On tabarr.uk, subscribers can access:

- Tabarruk’s folio live

- Updates with every purchase

- In-depth analysis of companies

- Step by step guides

- Articles (though most are free)

Anyone can learn to do what we did. We started with as little as $500 when we began investing, and you can too!

How? Plan long term and apply our key and advanced strategies. Learn from our articles and updates as we share our ASX stock purchases.

moin

moin