Our first update for 2022. As we discussed in our last update, 2 months ago.. the markets were heading to all time highs and were due a correction. We are well and truly in one and what the next phase brings is going to be quite interesting.

The ASX 200 (XJO) fell from 7,600 way down to under 7,000 (a drop of over 10%).

Companies have begun releasing quarterly updates.

The likely market correction we spoke about previously based on technical analysis seems to have eventuated. It is not one to be alarmed about for long term investors. They are healthy and return markets back to fair valuations and provide buying opportunities. This last part of the year can typically be a ‘Santa Rally’ heading into the festive season and new year.

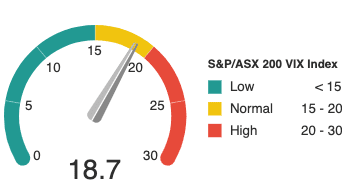

The ASX VIX (volatility index) has finished the month higher at 18.7.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

CEO Insights

Retail

“I talk to the CEOs of almost every major retailer around the world. They are thinking full omni[channel] now. Like how do we engage with consumers digitally, not how do we attract them to our store”

Dan Schulman, CEO, PayPal Holdings Inc

Banking & Payments

“I think there’s more change going on in our industry today and over the next 3 to 5 years, than we will have seen in the past 10 or 20 years”

Dan Schulman, CEO, PayPal Holdings Inc

“From where we sit today, customers have largely paid down their debts, repaired balance sheets, saved money and are now ready to get out there to invest and spend”

Shayne Elliott, CEO, ANZ Banking Group Ltd

Labour Markets & Workplace

“Everybody’s still finding their way [back in the office] and then you get the omicron variant, who knows, we’ll have pi, we’ll have theta and epsilon, and we’ll eventually run out of letters of the alphabet. It’s continuing to be an issue”

James Gorman, CEO, Morgan Stanley Inc

“We expect the war for talent to be a key theme over the next three-to-five years”

Steve Johnston, CEO, Suncorp Group Ltd

Childcare

“There is no doubt that retention of educators is a real issue across the sector”

Gary Carroll, CEO, G8 Education Ltd

Commercial Property

“We expect early-cycle rises in interest rates to have limited impacts on commercial asset values because they are associated with a strong economy”

Darren Steinberg, CEO, Dexus

Health & Fitness

“2021 has been a challenging year for digital fitness and as I mentioned on our last earnings call, we have seen increasing pressures on CAC [customer acquisition costs] that are impacting the entire industry”

Calvin McDonald, CEO, Lululemon Athletica Inc

Domestic Economy

“Car sales are expected to lift next year, home construction should continue to be strong, and already we’ve seen business registrations double since COVID restrictions lifted”

Nick Hawkins, CEO, Insurance Australia Group Ltd

“One measure of economic activity is the commitment companies are prepared to make to media advertising, and we are seeing strong demand for TV and digital advertising across late 2021 and into the new year”

James Warburton, CEO, Seven West Media Ltd

“The lockdowns have made inner cities very unappealing and prompted tree change and sea change moves. It has also triggered disruptions to the labour market, and induced early retirement decisions”

Eliza Owen, Head of Research, CoreLogic

Airlines

“We know that for every dollar spent on a ticket a further $10 gets spent in the economy. It will no doubt take 12 to 24 months, assuming no further big demand shocks, to get demand back in balance”

Jayne Hrdlicka, CEO, Virgin Australia

Consumer Behaviour

“There is pent-up demand, and consumers will want to treat themselves as a reward for two years of constrained choices”

Amanda Lacaze, CEO, Lynas Rare Earths Ltd

Supply Chain

“I think we’ll have a white-knuckle ride [into Christmas] not in consumer demand but in having the stock there for them to buy”

Brad Banducci, CEO, Woolworths Group Ltd

Computers & Technology

“This demand momentum is unbelievable”

Tarek Robbiati, CFO, Hewlett Packard Enterprise Co

Food & Agriculture

“Based on current estimates, to meet the needs of the growing population, we will need to produce more food in the next 40 years than we have in the past 8,000 years sustainably and while matching new consumer expectations. Think about this. This is the challenge of a lifetime”

Juan Luciano, CEO, Archer-Daniels-Midland Co.

Pets

“A lot of us are focused on functional foods and beverages to increase health resiliency and we are extending that view to the pets we own in what is being called the humanisation of pets”

Juan Luciano, CEO, Archer-Daniels-Midland Co.

Lithium & Batteries

“After decades of investment by the battery industry, we’re starting to see that cost come down, approaching that $100 a kilowatt hour cost which is so pivotal for the tipping point for economics [of electric vehicles] to be on even footing or better as time goes on versus internal combustion engines”

Eric Norris, Lithium CEO, Albermarle Corporation [major global lithium producer]

AdBlue / Diesel Exhaust Fluid Supply Crisis

“We’re effectively in a bidding war on an hourly basis”

Simon Henry, CEO, DGL Group Ltd [Australia’s largest AdBlue manufacturer]

“Uncertainty can cause more damage than actual shortages, and the recent nervousness around urea and AdBlue is illustrating how vulnerable our supply chains can be”

Innes Wilcox, CEO, Australian Industry Group

Earnings Season Gives a Look Beyond Market Tumult

On Thursday, the froth in markets continued to eke down like the deflating foam in a root beer float. The Nasdaq fell to its lowest level since last June and the small-cap Russell 2000 entered official bear market territory by dropping 20% from its peak.

While markets will always do their thing, here’s a peek at how the businesses behind the stock prices are faring:

An Apple a Day Keeps Supply Chain Problems Away

Apple cautioned investors in recent months that supply chain woes and resulting parts shortages would impact its business. The company went ahead and posted its best-ever fourth-quarter results anyway. Despite the supply chain slowdown, the Silicon Valley tech giant banked a record $34.6 billion profit in the quarter, 10% better than analyst estimates. iPhone revenue — which is heavily dependent on a healthy supply of parts — totaled $71.6 billion, up 9% from a year ago, and way out in front of the average analyst estimate of $67.7 billion.

What’s Next: CEO Tim Cook hinted that Apple will soon be in an even stronger position, telling The Wall Street Journal, “We’re forecasting that we will be less constrained in March.”

McDonald’s Showed Labor and Inflation Burdens Aren’t Going Anywhere

On Thursday the fast food king announced that it’s doing what it’s supposed to do: selling burgers. Global same-store sales rose 12.3% in the fourth quarter, better than the 10.5% increase Wall Street expected. But the company’s $1.6 billion profit fell short of expectations, as the weight of inflation — higher prices for everything from meat to wages to vegetable oil — compressed profit margins.

What’s Next: McDonald’s said it expects to open more than 1,800 restaurants this year and it will unleash $2.4 billion in capital expenditures. Meaning both more and fancier Golden Arches in 2022.

More updates and video on market and portfolio companies for members follow below.