Global markets, have had a started November pretty stable before ending weakly amid scares of a new COVID variant.

The ASX 200 (XJO) fell from 7,600 way down to 7,200 (a drop of 5%).

Companies have completed releasing quarterly updates.

The likely market correction we spoke about last month based on technical analysis seems to have eventuated. It is not one to be alarmed about for long term investors. They are healthy and return markets back to fair valuations and provide buying opportunities. This last part of the year can typically be a ‘Santa Rally’ heading into the festive season and new year.

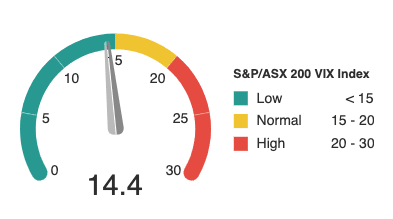

The ASX VIX (volatility index) has finished the month higher at 14.4.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

CEO Insights

Financial Markets & Banking

“When I step back and I think about my 40-year career, there have been periods of time when greed has far outpaced fear. We’re in one of those periods. Generally speaking, my experience says that those periods are not long-lived. Something will rebalance it and bring a little bit more perspective”

David Solomon, CEO, The Goldman Sachs Group Inc

“The increase in banknotes in circulation against the backdrop of declining transactional cash use can be attributed to the growing role of cash for precautionary and/or store-of-wealth purposes”

Market Statement, Reserve Bank of Australia

Cryptocurrency

“In my view, consumers should approach investing in crypto with great caution. The maxim, ‘don’t put all your eggs in one basket’, comes to mind”

Joe Longo, Chairman, Australian Securities & Investments Commission

“As an industry, and as a government, we need to acknowledge this is not a fad. Don’t be the person in 1995 who said the internet was just a place for geeks and criminals and would never become mainstream. And don’t be the person who argued that email was a passing fad. If the last 20 or 30 years have taught us anything, it’s that all innovation begins as disruption and ends as a household name”

Jane Hume, Financial Services Minister

Technology & Telecommunications

“Every second, 127 devices hook up to the internet for the first time”

Market Statement, Altium Ltd

“As we look forward, all signposts point to continued strong market demand”

Chuck Whitten, COO, Dell Inc

“The idea falsely promoted by the platforms that algorithms are somehow objective and solely scientific is complete nonsense. Algorithms are subjective and they can be manipulated by people to kill competition and damage other people, publishers and businesses”

Rupert Murdoch, Chairman, News Corp.

Electric Vehicles

“Absolutely it’s a Kodak moment. Some [fuel retailers] are already closing. And you’re starting to see in the United States signs up to sell not just petrol…but also electrification with a price next to it, which is a change we haven’t seen yet in Australia”

Jane Hunter, CEO, Tritium [E.V. charging infrastructure company]

Housing

“Consumer confidence is high, especially in NSW, with similar trends expected in Victoria. It pays to be a tradie, with record job numbers up for the taking“

Roby Sharon-Zipser, CEO, Hipages Group Holdings Ltd

“Many Australians are clearly on the brink and are sleepwalking into disaster, living in the false hope that rates will stay this low”

Peter White, CEO, Finance Brokers Association of Australia

E-Commerce

“I think we have witnessed a very healthy growth and very rapid growth [in China] and if you look at the penetration of e-commerce in many other markets outside China, I think it’s still in a very early stage”

Daniel Zhang, CEO, Alibaba Group Holdings Ltd

Consumer Spending

“There’s more money sitting in bank accounts in Australia than there ever has been”

Gerry Harvey, Chairman, Harvey Norman Holdings Ltd

“We’re expecting a really strong holiday season, and it’s all being fuelled by a super-strong consumer right now, the home balance sheet has probably not been stronger than this in a real long time”

Chip Bergh, CEO, Levi Strauss & Co.

“The overall athleisure trend and further casualisation of society [is driving demand]. Some of this is aided by the continued work-from-home environment, some of it by the new return-to-work hybrid model, but overall, people want to be more comfortable”

Dick Johnson, CEO, Foot Locker Inc

Labour & Skills

“Border restrictions are expected to be relaxed in the coming months, however with demand remaining strong across all industries, labour constraints are expected to continue for some time”

Rob Velletri, CEO, Monadelphous Group Ltd

“As we reflect on the [last] 18 months, I would say, I’d much rather have a supply problem than a demand problem”

Sonia Syngal, CEO & Director, Gap Clothing Inc.

Universities & International Students

“March is traditionally one of the largest university intakes for new international students, [but] given the late timing of the government’s announcement we believe that we won’t see significant new intakes of international students in Australia until July 2022”

Jake Foster, CCO, AECC Global [International overseas education consultancy]

“There is some serious global competition now for international students, with countries like Canada and the United Kingdom rolling out the red carpet”

Jake Foster, CCO, AECC Global [International overseas education consultancy]

Travel & Aviation

“It’s interesting for us to note as an organisation that runs a global business to see that where demand does come back, it comes back in a hurry”

John Guscic, Managing Director, Webjet Ltd

“The sheer physics of flights, and the cost associated with the technologies to be developed, means that this is a lot more complex [to make electric engines] than it is with automobile technology”

Tony Douglas, CEO, Etihad Airways

Energy & Mining Services

“Customers are continually pushing production by extending the life of their fleet, creating a high level of demand for support activity. Customers are also focused on optimising their fleet over the long term. We have seen the first wave of technological step-change through autonomous haulage, which is ongoing and expanding from trucks to other ancillary equipment”

Ryan Stokes, CEO, Seven Group Holdings Ltd

Healthcare & Hospitals

“In recent years, dramatic consolidation of generic drug buying groups, pharmacy benefit managers and health insurers has created significant downward pressure on manufacturers margins, both generic and specialty brands. At the same time the out-of-pocket cost of drugs to patients is rising and prescribers are being given less choice on patient treatment”

Scott Richards, CEO, Mayne Pharma Ltd

“And the other thing that I see the hospital [industry] is doing, where we’re spending a lot of time with them is adoption on more remote capabilities and business models”

Geoffrey Martha, CEO, Medtronic plc

More updates and video on market and portfolio companies for members follow below.