Global markets, have had a weak month overall after a period of touching record highs.

The ASX 200 (XJO) fell from 7,600 all the way down to 7,150 (a drop of 6.5%) and then rallied back to 7,450 before ending the month at 7,323 range.

Companies are continuing to release quarterly updates.

We spoke previously about the market and the likelihood of a correction based on technical analysis. It is not one to be alarmed about for long term investors. They are healthy and return markets back to fair valuations and provide buying opportunities. This last part of the year can typically be a ‘Santa Rally’ heading into the festive season and new year.

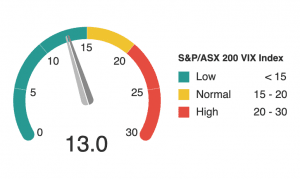

The ASX VIX (volatility index) has finished the moth at 13.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

CEO Insights

Financial Markets & Banking

“It’s difficult to overstate how transformative blockchain technology, digital assets and the thousands of decentralised apps that have yet to be created could potentially be. We expect rapid changes to the current market structure – new use cases will be discovered, and others will be discarded”

Market Statement, Bank of America Corporation

“No matter what anyone in the room thinks, nor what any libertarian thinks, nor what anyone thinks about it, government’s going to regulate it”

Jamie Dimon, CEO, JPMorgan Chase & Co

Technology & Telecommunications

“We’re in the worst of it now [semiconductor shortage], every quarter next year we’ll get incrementally better, but they’re not going to have supply-demand balance until 2023”

Pat Gelsinger, CEO, Intel Corporation

“We are also seeing an acceleration in our consumer IoT business, driven by rapid growth in devices such as VR headsets, smart exercise equipment, and smart speakers”

Sanjay Mehrotra, CEO, Micron Technology Inc [one of the world’s biggest computer chip makers]

“We’re all chasing each other in this massive musical chairs being played across the industry, where we get [staff] from the banks and the banks get from us, and then the energy companies do the same, and then we go and steal the mining company’s cloud people; so it’s just a mess”

Nikos Katinakis, CEO Networks & IT, Telstra Group Ltd

“There is a technology revolution going on. There is compliance and getting operational resilience things right but we also have to keep up with the world of technology, which is changing so quickly”

Dominic Stevens, CEO, ASX Ltd

Housing

“A buoyant housing market and a reduction in travel spend are also supporting the growth of our sector”

Mark Coulter, CEO, Temple & Webster Ltd

“While the banking system is well capitalised and lending standards overall have held up, increases in the share of heavily indebted borrowers, and leverage in the household sector more broadly, mean that medium-term risks to financial stability are building”

Wayne Byres, Chairman, Australian Prudential Regulatory Authority [APRA]

“The sector is enjoying positive growth, which we start believing can become structural”

Antonio Achille, CEO, Natuzzi S.p.A [Italy’s largest furniture company]

Consumer Spending

“The end of lockdowns will no doubt have the world return to a more “normal” distribution of discretionary spend”

Mark Coulter, CEO, Temple & Webster Ltd

“We are seeing the world shift; it has been going on for some time… The greater financial literacy [of younger generations] means people shop around more and Australian consumers are extremely sophisticated in how they think about which products they consume”

Chris de Bruin, CEO Consumer & Business Banking, Westpac Banking Corporation

“There’s a lot of catching up to do. There’s $100 billion extra sitting in people’s bank accounts. We expect a fair share of that to be spent on food and drink”

Steven Cain, CEO, Coles Group Ltd

“In Australia, I think retail is going to be fine. We’ve got the advantage of knowing what happens when other countries opened. Australia is sort of lagging from that point of view”

Brett Blundy, Chairman, Lovisa Holdings Ltd

“Across the world consumers seem to be looking at pricing a little bit differently than before…consumers are shopping faster in-store and they might be paying less attention to pricing as a decision factor, and they might be giving more relevance to the brands that they feel a bit closer to…We’re seeing less [price] elasticity”

Ramon Laguarta, CEO, PepsiCo Inc

Labour & Skills

“From a wage inflation point of view in the market, what we’re seeing is that there’s more pressure at the lower end of the wage spectrum where there is a lot of movement there to attract people to jobs that have been really hard hit during the pandemic”

Martine Ferland, CEO, Mercer Inc

“One size fits all is dead. The corporate headquarters as we knew it, 9-5, five days a week, corporate HQ, I don’t think we’re ever going back to that”

Marcelo Claure, Exec. Chairman, WeWork Inc

“The labour market and labour shortages have replaced returning to work as the conversation starter for everyone”

Jane Fraser, CEO, Citigroup Inc

“There is already a lot of demand for engineers, supervisors and health and safety professionals, and this will just increase in coming years”

Joe Barr, CEO, John Holland Group

Travel & Aviation

“People are optimistic but cautious; they’re keen to go overseas again, but they’re mindful of the risks”

Simon McGrath, CEO, Accor Hotels APAC

“A lot of today’s issues should be in the rear-view mirror by then. It is a great time to start an airline; there is pent-up demand, and we can also leverage good opportunities in the aviation market like cheap jets”

Tim Jordan, CEO, Bonza [new Australian low-cost airline]

“International leisure bookings have now surpassed domestic bookings in Australia for the first time since the start of the pandemic and almost tripled between July and September”

Graham Turner, CEO, Flight Centre Travel Group Ltd

Energy & Mining Services

“We continue to see strong market demand from our customers across Australia for DDH1’s industry leading drilling services, particularly across gold, iron ore and – increasingly – battery minerals”

Sy van Dyk, CEO, DDH1 Ltd [major Australian drilling company]

“Copper is critical to the global shift to decarbonisation and this is a shift we are participating in as a company”

Sandeep Biswas, CEO, Newcrest Mining Ltd

“I’d compare green hydrogen to the beginning of the Industrial Revolution where everything changed. And I see this legitimately as the next great industrial revolution, but this one is entirely pollution free”

Andrew Forrest, Executive Chairman, Fortescue Ltd

“By our analysis if governments and private sector continue to develop energy infrastructure the way we always have, we won’t get to net zero by 2050. We might not get even half-way”

Chris Ashton, CEO, Worley Ltd

Automotive

“The modern automotive industry has heard this message loud and clear. If you don’t give your customers an electric option, they won’t stay your customer for long”

Behyad Jafari, CEO, Electric Vehicle Council

“Elon Musk would have you believe everyone will be owning an electric vehicle very soon…There is certainly no technology that is going to replace the tractors and trucks out there”

Simon Henry, CEO, DGL Group Ltd [ASX listed diversified industrials group]

Entertainment

“In Entertainment, with cinemas reopening globally, studios began to release blockbuster films and the immediate demand for the cinema experience was evident”

Market Statement, Event Hospitality & Entertainment Ltd

“It is also encouraging to see our Theme Parks business continue to receive strong support from the local drive market”

Gary Weiss, Chairman, Ardent Leisure Group Ltd

Health & Wellness

“The behavioural science tells us that when people learn to cook in early age, they continue to cook at elevated levels as they get older, and consumers of all ages are rediscovering their kitchens, and cooking more at home”

Sean Connolly, CEO, Conagra Brands Inc [major global packaged food brand conglomerate]

“Another enduring trend is the growth of snacking, which has long been the fastest growing occasion in food and shows no signs of slowing down”

“I think during the pandemic, we’ve proved to the world what we can do if we work differently ourselves but also if the interactions with regulators is different and has a higher sense of urgency. So then if you could do that for COVID, why not for cancer? Why not for rare diseases? Why not for inflammation, cardiovascular disease?”

Albert Bourla, CEO, Pfizer Inc

“Part of the tailwind we’re seeing is sport is becoming part of everyone’s everyday life. And that’s a powerful tailwind for us”

John Donahoe, CEO, Nike Inc

More updates and video on market and portfolio companies for members follow below.