This is a 5 part series that I’ve been thinking about for a while.

A conversation I have often with people looking to invest is how much to start with. While we think starting with 500 or 5,000 can lead to equally powerful results, the fact is, many people don’t know how much they can start with.

Or more to the point, they don’t know how much money they can afford to start with, because they don’t know how much they save.

You can’t know what you don’t measure. Data is key and it’s often in the dark.

Money Habit 1: Switch on the flashlight

Shine it on your money. Money coming in. Money going out.

Look at it and track it. Do it alone. Or with a friend. Or with your partner. Whatever works for you and you feel comfortable with.

Know what every single dollar in your account does. In other words, you need to track your money. Answer the following questions honestly:

What percentage of your income did you spend on living expenses, entertainment and investment last month?

Don’t deflect it as “Why is that important?” or “It doesn’t matter” if you don’t know.

You can be an executive sitting behind the desk in a bank, or even a high-flying project manager.

Truth is more money doesn’t make you more financially responsible, it just makes it easier to spend.

A survey in Australia found the following:

- Almost one-third (30 per cent) of Australians don’t set a budget

- Just under a quarter (24 per cent) aren’t saving any money at all

- Almost one in five (18 per cent) are living pay cheque to pay cheque

That’s almost ¾ of Australian citizens, one step from falling off a financial cliff.

Then COVID happened.

The rich and financially successful people say, the road to financial success is to start with one simple step.

Budget and track your expenses.

The way my father thought me to budget my money was to follow 2 simple steps.

Step 1: Percentages to goals

Based on what you’re striving for (e.g. buying a house, saving for your children’s education, getting married etc.) start with your total income and break it into percentages for different aspects of your life, with your big picture goals in mind.

As an example, I split it as follows many years ago, into 4 chunks.

- 50% goes towards your living expenses (includes mortgage/rent)

- 10% goes to entertainment

- 30% goes into shares

- 10% goes into a rainy-day account, that has no card linked to it

Step 2: Divide and conquer

The second step is to execute on the chunks you made by diligently tracking and funnelling money into these chunks.

The more detailed you can be, the better it is.

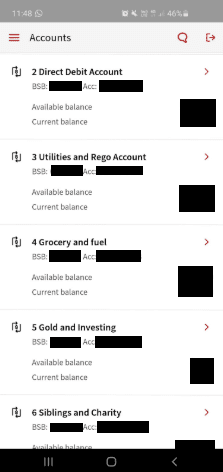

With internet banking and almost no cost or limit to how many bank accounts you can have, make an account for each chunk.

Here’s my current split of bank accounts as an example. This sets a clear delineation of your money and what role it serves you.

Growing wealth starts with knowing where you’re starting from. Whatever your motivation is, for a lot of us, there’s an aspect of wanting to make a difference. To our lives, to those of others. To help those with less. It’s a big part of why we created Tabarruk and decided to give 10% of our revenue to charity.

For us it’s extremely important because the main reason injustice and oppression occurs today is that money talks and those with good intentions usually have shallow pockets.

As a result, the possibility to make meaningful change is limited.

Some may say, we live in the age of social media and everything is interconnected. While this may be true to some extent, everyone has bills to pay and no matter how true a cause, the need to keep a roof over their heads will have most people return from the streets to a cubicle in an office (or your desk at home) working some kind of 9 to 5 job.

If you want to make a change, influence society in a meaningful way, remember that change starts with us and by apply the financial habits of the rich and powerful to better our lives, we can start on the path to financial freedom.

Stay tuned for the next part.

fahd

fahd