There’s obviously a lot of content flying around about the US elections and it’s impact on the markets, including predictions of what could happen based on different outcomes.

We’ve never invested based purely on predictions. Our philosophy is based on strong conviction backed by in-depth research, which often leads to the best growth results over the long term.

What we do factor in, is observable data. Like volatility.

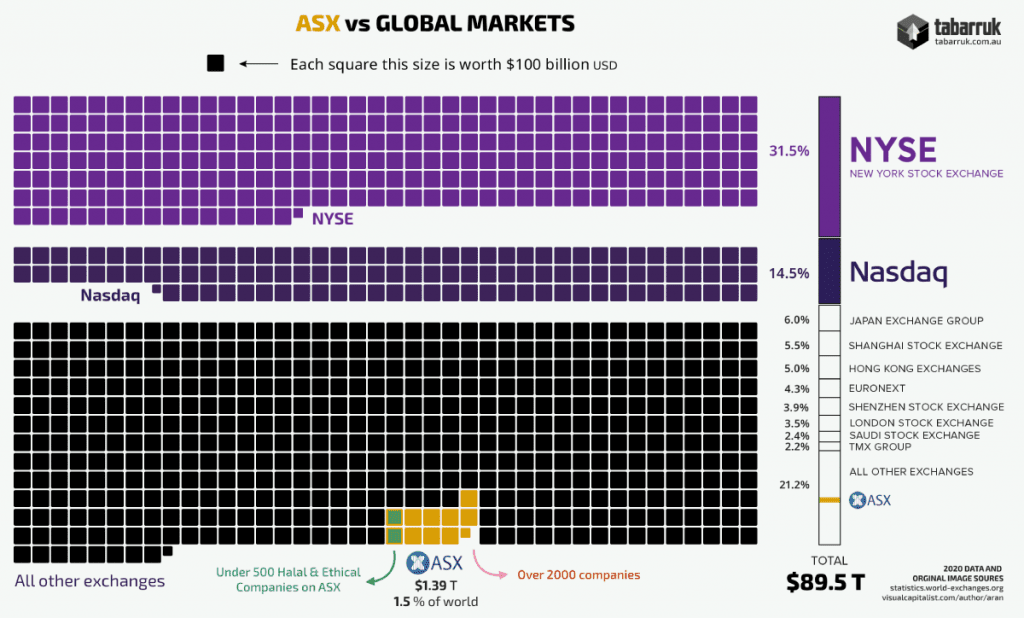

How the global markets relate to the ASX

We posted an infographic earlier today on LinkedIn, Twitter and Facebook.

While there, make sure to like, subscribe and follow if you haven’t already.

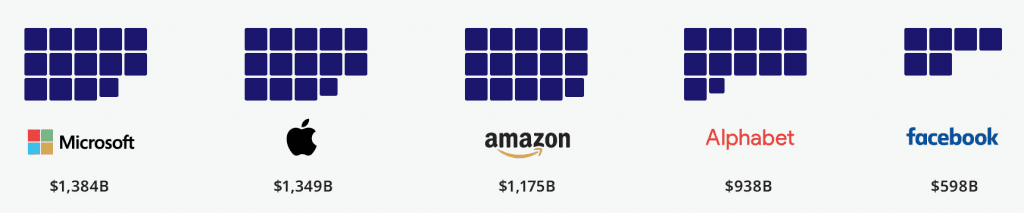

What the infographic we posted doesn’t show is that 4 of the top 5 companies in the US are bigger than the total market cap of the ASX.

So with the US markets making up almost 50% of the world’s markets, it stands to reason that when they go through volatile periods, it has an impact on the rest of the world, including the ASX, which is 1.5% of the global markets.

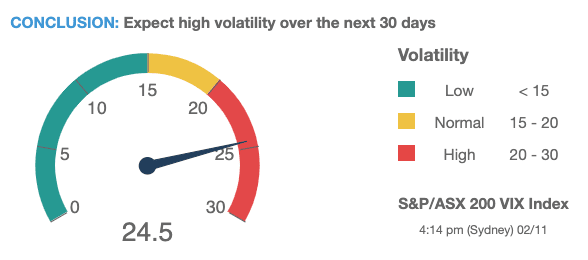

Measuring Volatility

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the ASX over the next 30 days. It is also known by other names like “Fear Gauge” or “Fear Index.”

As you can see, the volatility spiked to a peak around the March covid crash before levelling out over the next few months. There is a clear uptrend forming from the last 2 week period.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

Today’s VIX reading is around the 24.5 points reading.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

Approach to planning for volatility

Besides the Democrats vs Republicans outcome of elections in the US, there is another possible outcome.

Australia being isolated in a way, and appearing to have come through the worst of the pandemic in better shape than other economies, we could be seen as a safe haven for the global economy.

So how do we plan to approach investing in this period?

Members, read on to learn what our plans are.