We’re here today because I lost everything

My journey with finance started around ten years ago. It’s something I struggled to share with others for quite a while.

It’s because I lost everything.

Every dollar I had saved, I lost by trusting the wrong person.

This incident in my life made me realize how much I didn’t know about finance. How I was living blindly. I now think it’s surprising I didn’t experience a catastrophe earlier.

After this incident, I decided to educate myself and sought out a finance course, and it changed my life.

Moin and I both have a lot in common. one of these things is that we went to good schools, grew up in loving middle-income families, and our parents provided us with the best of what they could afford.

This made my loss more jarring in a way and shook me to my core.

However, for all that, I am now thankful and look on it as a catalyst for learning and growth. Before that, I’d never learned about the basics of finances.

Dummies for Finance, Finance for Dummies

It’s kind of funny that being a dummy and losing all my finances led me to pick up a book perfectly titled “Finance for Dummies”

I was a sponge and absorbed the knowledge hungrily as I was going through this journey. I realized that I was looking up to the wrong type of people.

I got fooled by what I now call proactive marketing.

The people I looked up to may have had nice cars and lived in rich suburbs, but they were struggling financially.

They had made a bunch of financial mistakes in their lives, and it held them back. Not only did these mistakes hold them back, but it slowed them down too.

What this epiphany did to me was make me realize that even though something may look great from the outside, you never know what’s happening behind anyone’s closed doors. People go to extremes to hide their struggles from the world. I put this down to the fear of being stigmatized.

If someone had just shared a few basic things on finance with people like this, or with me before my incident, it would have dramatically changed our trajectory.

Finance only cares about one thing

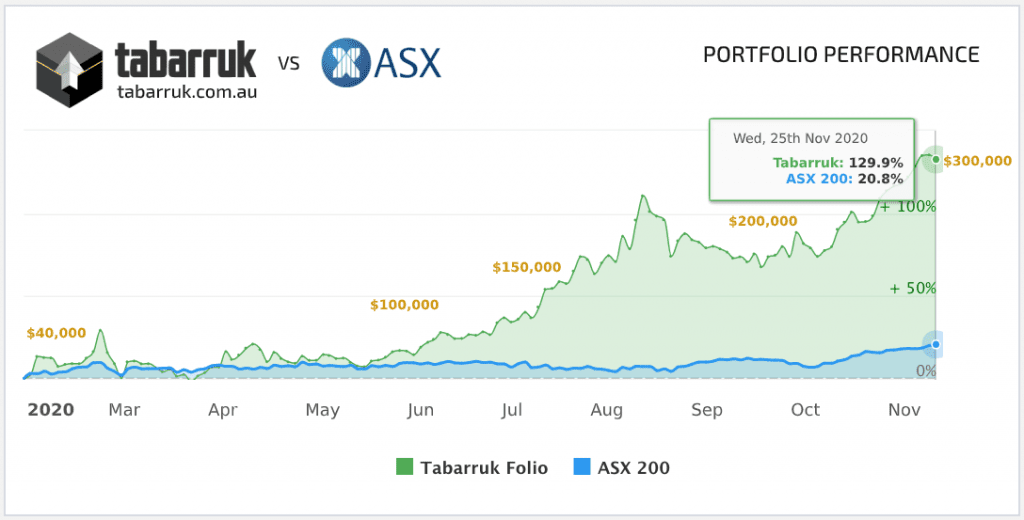

It’s a big reason behind why we started tabarruk, we want everyone to have a source to learn something the easy way, instead of the hard way like me and being forced to by circumstances, so if you learn something here, and like it, we encourage you to share and ask other’s to join us.

The great thing about finances is that it doesn’t matter how bad your situation is, you can always improve it.

What matters is being brave and proactive. Finance doesn’t care how old or young you are, or how rich or poor you are.

All that finance cares, is that you are doing the right thing.

It all starts with you putting a plan in place, and you will be able to see specific, measurable accomplishments like paying off your credit card, your loans.

Having money in the account to pay your bills and then some can make you realize the potential it has in changing your life.

You control your finances, not the other way around

Having a positive control of your finances will change your life. If you’re in a relationship, it can be a breakthrough in your marriage or partnership with your significant other. You will find out that you’re no longer fighting about money and that you both are cooperating towards a common goal.

When I started managing my money, more and more people began to notice a difference in my demeanour.

I was calmer and carried myself better, and after a little time had passed since my financial disaster, I was secure in the knowing of what was coming into my pocket and what was going out of it.

I was not blindly throwing money at my bills and debts without a consolidated plan.

Being organized with my money brought a lot of unintended positive changes in my life.

My relationship with my family dramatically improved; I was a better son, a better brother. And because my money was working for me, instead of against me, I was less stressed.

The three main ways in which money affects our lives are:

- Relationships

- Work

- Lifestyle

The most prominent struggle people face when coming up with a course of action is not having an idea of how they should live? Or how much money they need? Or if what they have is enough. I can assure you one constant thing is will be is, it will never be enough.

Let’s look back 5 years. You were probably earning half of what you’re making today. If your income has increased, how is it that you still feel you’re struggling?

I cannot stress how important it is to have a plan in place to manage money. If you have a roadmap you will know what impact it has on our lives to stay on top of it.

At the end of this article, I want you to take action. I challenge you to use what you learn and give us feedback if it helped.

The purpose of this article is to inspire people to take that step to get free and be able to pursue their dreams.

We weren’t created to work, pay bills and die.

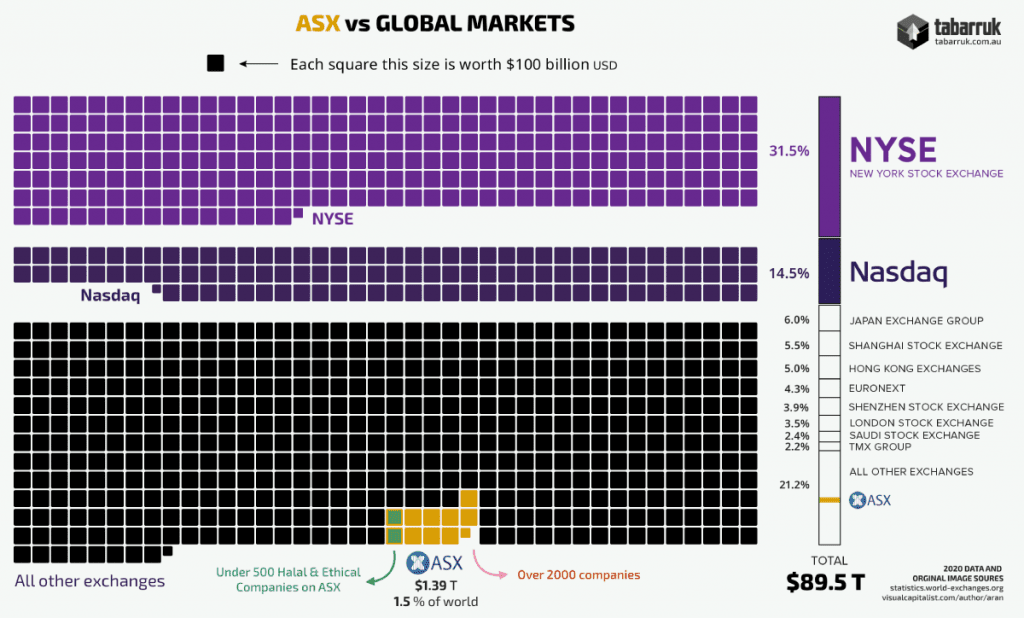

Let me share with you some facts.

The average household has

- a credit card debt of $16,000,

- a car loan of $28,000,

- mortgages of $172,000

These financial burdens have genuine physical manifestations in our lives.

They come out in the form of stress, migraines, depression, fear, worry, anxiety and these symptoms which consume people are the main reason I’m so passionate about teaching people the path to financial freedom.

A little bit of education goes a long way in making a positive change in someone’s life.

I advise you not to go out looking for more statistics because it is depressing. What’s that? You like statistics?

Ok, then.

82% of the world lives paycheck to paycheck, and that’s people with jobs. That’s an astounding number because this means 2.4 billion people around the world are just getting by, and that’s scary because that means most people don’t have enough savings.

These people are pretty much surviving; they don’t have a good plan, they don’t have much in the way of financial advice and are overwhelmed by their situation that when an emergency happens, they default on their payments.

The first to default is their credit cards, and because they don’t have means to pay it off, it adds to their problems.

Disclaimer: I put my hand up and say that my Master of Science in banking and finance didn’t teach me anything about real-world issues. My parents and my failures in life taught me more than that piece of paper. All that my masters did was provide me with a false sense of superiority, which all came crumbling down when I hit rock bottom.

I want you to know that just because I have a plan doesn’t mean that I don’t have challenges, life is, after all, unpredictable.

I am the provider for my family now. Last month my younger brother needed a new pair of glasses, and my younger sister needed $1000 for her course.

Life is always going to be challenging that being said if you’re prepared for it, you can hunker down during these situations, and it’s not going to knock you down and dictate your life.

Money is not the most essential thing in life; however, it is not something we can ignore. It affects our relationships, work, and lifestyle.

Relationship to money, money to relationships?

Your relationship with your partner or family may be your cornerstone in life and you would be surprised how understanding and learning to do ‘money’ better will improve your bond.

Your communication with your partner may not be the best when it comes to money, could be because you have a different background, have different likes and dislikes and think differently. It’s heavy to talk about sometimes and even heavier to admit to another that things aren’t the best and that help is needed.

A simple strategy can help. At the beginning of every month before you spend anything, agree on a budget with your partner and decide on where the money is going to go.

For this to succeed you need to make it safe to communicate objectively, open dialogue about all the money coming in and money going out.

By being transparent with each other, it will teach you to work as a team, when to say no and when you can splurge or reward yourselves.

You have opportunities to set things up in advance. Having a budget will hold you accountable as a team to say no when the circumstances are not right.

If you’re single, your whole social life is dictated by money. Going for movies, coffee and your biggest struggle will probably be finding a balance between your social life and having a plan.

Have a budget means setting aside a small amount for yourself and this will allow you to go out for a meal, coffee and when you do that knowing exactly how much you can spend you will be able not to spend money frivolously.

Your social life has to adjust to your priorities in life.

Sometimes you have to tell your friends that your making a stand to be financially healthy. As a result, your closest friends will begin to notice changes, and you may influence them to make some positive choices in their own lives to nudge them on the right path.

Money affects every relationship you have, and it is imperative to understand this, which allows you to improve and have better relationships.

Work, work, work

The second part of our lives money effects is work. I mentioned earlier that 82% of people around the globe are living paycheck to paycheck. The sad thing is out of 82%, more than half of them would have quit their jobs if money was not an issue for them.

They don’t like their jobs, and they are sticking out merely to pay their bills.

Money can keep you captive in a place you’re not content with, a position or career you’re not happy with sucking the lives out of you.

So, loving your job is what you want, and if you’re not, you need to plan your finance so you can transition your life into something else.

Lifestyle is a choice

The third and last area that money affects is your lifestyle. Most people are too busy looking around and comparing their lives to other people’s lifestyles; it is human nature.

So how do you determine what is the right lifestyle for you?

How do you decide where you live, what car you drive, the clothes you wear and what you do?

How do you know whether that’s right for you?

You would be surprised by the number of clues you have in deciding what lifestyle to choose; I think everybody knows what they need to be happy but chase after the wants to fulfil a false narrative in their minds.

Most people never struggle to live a lifestyle that’s double their income.

However, ask someone to live with half of what they make, and you will see people fail to accomplish this.

Overspending is a trap I see many people getting snared by; How do I know?

I know because I fell face-first into it myself.

It’s not as if people are earning $500 and spending $1000. It’s more like people are paying an extra $2 for every $50 they make.

Over time, if you’re paying the extra 1000 dollars every year, you’re not feeling it at first, and you’re enjoying the lifestyle that is slightly beyond your means.

However, one day you might lose your job, or maybe there was an emergency and all of a sudden you feel the weight of some of those decisions you felt before.

Some studies show having a little bit of money in savings, brings a lot of peace, contentment, and enjoyment to your life.

Hopefully, this article showed you how money affects you, and that money doesn’t take the place of fulfilment or happiness in your life.

It’s a tool that helps you experience life positively.

Remember it affects your relationship, your work, and your lifestyle. So, getting money right is essential, and I hope you join us on this journey because we want us all to walk together for a long time and experience success together.

Learn all you can and share with those you care about to influence them positively.

Read books and grow your mind and never stop learning.

However, remember that knowledge is not power on its own. Implementation of the knowledge, now that is power.

fahd

fahd