The quiet, deceptive bull market continues. The numbers show almost 7,100 points for the ASX 200 with a high last week of almost 7,200. The reality is a different kind of K shaped pattern emerging with the technology and related sectors that did well last year, coming off the boil and Materials and banks etc. are seeing a rise. Also companies that were trading well above fair value are coming back to earth. Money is also being taken out of the riskier / more speculative end of the ASX and used in different ways. Crypto has increased in popularity. This is all part of the cycles a market goes through over time and as long term investors would attest to having experienced.

The Federal Budget was also announced for 2021, yesterday.

Federal Budget 2021 key takeaways

- Additional 1.9B allocated for vaccine rollout

- 1.5B for COVID related health, testing, respiratory clinics and telehealth

- Tax cuts for low and middle income earners. Individuals to get $1,080 and couples $2,160

- Additional 10,000 first home buyers able to buy with 5% deposit

- 10,000 single parents able to buy with a 2% deposit

- First Home Super Saver amount increased to 50k from 30k

- 60 years olds and over can contribute 300k to their super by downsizing home

- 19B for universities

- 17.7B in new aged care funding

- 15B for new terminals in Melbourne and Sydney

- Spend 13.2B for NDIS over 4 years

- 10B guarantee to make insurance cheaper in Norther Australia

- 2.3B for mental health and suicide prevention

- 2.1B allocated for aviation, tourism, arts and international education

- 2B for pre-schools

- 1.9B for national security over a decade

- 1.7B investment in childcare

- 1.6B for tech including clean hydrogen and energy storage

- 1.2B for digital infrastructure, skills and cybersecurity

- Launch of new patent box for medical and biotech sectors for concessional tax of 17% for income from new patents

- 1.1B funding from women’s safety

- 600M for community relief from natural disasters

- 480M for environment, 100M for ocean protection

- 170M to boost internet and mobile coverage in regional areas

- $450 monthly minimum income threshold removed for super guarantee

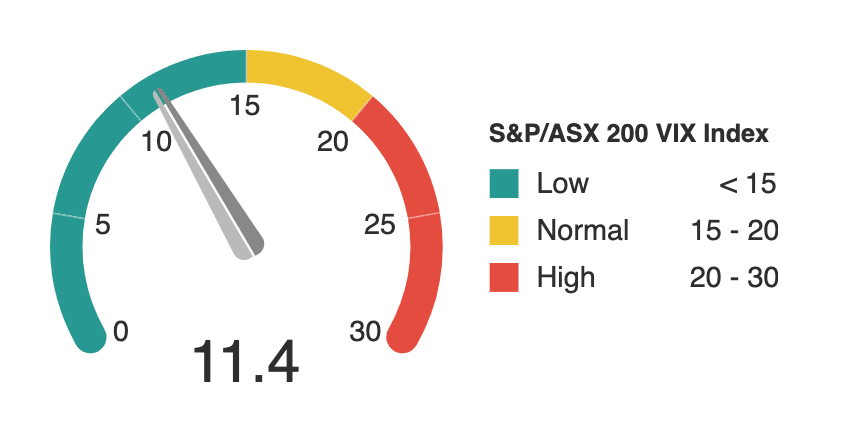

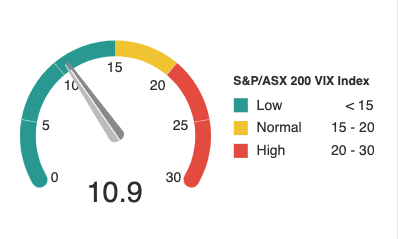

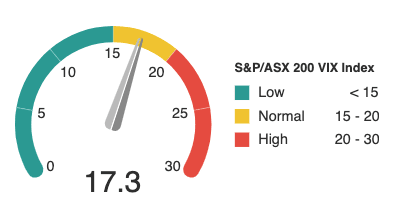

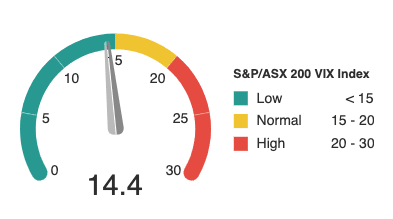

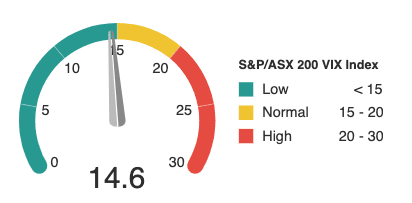

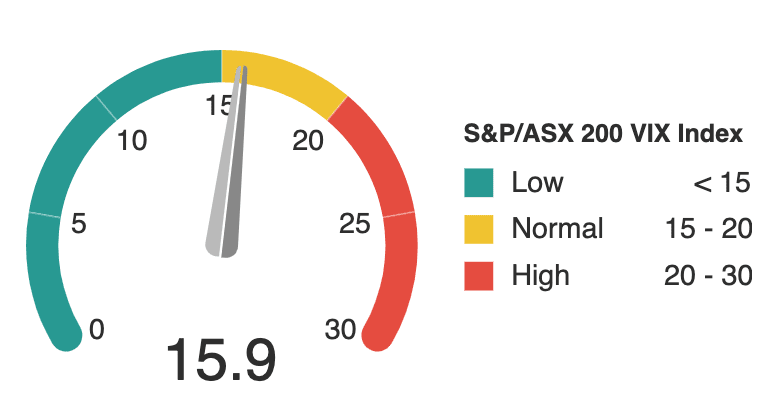

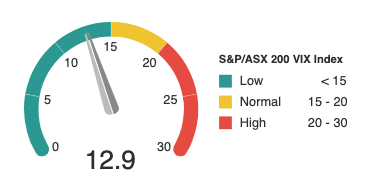

The ASX VIX (volatility index) has crept up close to 13. Interestingly, the VIX in the US has gone up higher.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

CEO Insights

Travel & Leisure

“We’ve seen strong demand since the [NZ travel] bubble was announced, with tens of thousands of bookings made in the first few days”

Alan Joyce, CEO, Qantas Airways Ltd

“Safety has always been an important consideration for travellers in terms of destination choice, and Australia has always ranked highly in this regard, but the latest research shows it is increasingly becoming a competitive advantage for Australia”

Phillipa Harrison, MD, Tourism Australia

“So outside of China, I think pay television peaked about 800 million households, and that was several years ago that it peaked [so we have] lots of room to grow”

Reed Hastings, Co-CEO, Netflix Inc

“It is very clear from both customer feedback and client activity that businesses are keen to get back on the road. Corporate travel and company success are highly correlated”

Jamie Pherous, CEO, Corporate Travel Management Ltd

“Through the use of our products, business leaders were able to see that flexible work could and should be something that continues long after the pandemic. Not only because data shows it’s what employees want, but also because it’s what can help our environment”

Bill Wagner, CEO, LogMeIn [remote working collaboration tool]

Workplace & Employment

“For every 100 employees, we may need seats for only 60 on average. This will significantly reduce our need for real estate”

Jamie Dimon, CEO, JP Morgan Chase & Co.

“All tenants are saying those days [10 square meters per person] are gone. The reversal, going back to 14 square metres per person is a massive change for the market which will offset the demand drain caused by people working from home two days a week”

David Harrison, CEO, Charter Hall Group

“I think we are entering a period where it starts to get less cool to work from home”

Harold Goddijn, CEO, TomTom N.V.

“The pandemic has fundamentally changed the concept of work…This is going to drive the continued consumerisation of corporate IT and a new wave of innovation, from more versatile and secure technology”

Enrique Lores, CEO, HP Inc.

“Operationally, capacity across labour and transport markets remains tight in all regions and we continue to see increasing levels of lumber inflation”

Graham Chipchase, CEO, Brambles Ltd

Office Property

“Several lead indicators of office demand have now turned positive including elevated business confidence for the financial and professional services sectors and higher levels of job vacancies”

Susan Lloyd Hurwitz, CEO, Mirvac Group

“Clearly, that [office building] pressure remains very acute right now particularly in densely populated gateway cities and will remain challenging for some time to come. However, we strongly believe the pressures on Office will recede from today’s extreme levels, as vaccine rollouts continue”

Bob Sulentic, CEO, CBRE Group Inc

Healthcare

“AI [artificial intelligence] is technology’s most important priority, and health care is its most urgent application”

Satya Nadella, CEO, Microsoft Corporation

“The Australian vitamin and dietary supplement category has been [negatively] impacted by structural shifts as a result of COVID-19”

Market Statement, Blackmores Ltd

Telecommunications & Technology

“We heard from our customers that companies like Facebook, Amazon and Google were simply not doing their planned expansions and upgrades [of data centres] during COVID, even with all the pressure for more data and more bandwidth. As business conditions improve, we believe we will see a strong increase in investment in the space due to pent-up demand”

Gayn Erickson, CEO, Aehr Test Systems Inc [worldwide provider of testing systems for semiconductor manufacturers]

“In terms of what we’ve seen in the demand environment, I think, it’s one of the strongest demand environments that we’ve seen for a while”

Salil Parekh, CEO, Infosys Ltd [top 10 multinational IT consulting & outsourcing firm]

“We’re going to see [with 5G] much like we did with 4G, applications explode that we don’t even know today. We have no idea what they’re going to be…I mean, if you go back to the early days of 4G, no one expected we would be carrying the computing power and the number of applications we carry our pockets every day”

Chuck Robbins, CEO, Cisco Systems Inc

Venture Capital & Innovation

“We still have a long way to go before we see the level of venture funding that we need in order to meet the demand from our rapidly expanding innovation ecosystem”

Yasser El-Ansary, CEO, Australian Investment Council

“We feel that the next two to three years will be the best there’s been for innovation and new companies since the 1994-99 era”

Paul Bassat, CEO, Square Peg Ventures [Australia’s largest venture capital firm]

Global Economy

“I feel we’re going to be talking not just about COVID-19, but COVID-22 and COVID-24, We’re going to have the stop-start economy for quite a while. I think we’re going to need to be prepared for a long haul”

Magnus Nicolin, CEO, Ansell Ltd

“Rising yields on the back of a robust recovery is a positive as opposed to rising yields solely on inflation concern. Moving away from very low rates lessens the search for yield and lessens distortions to financial and non-financial asset prices”

Doug Peterson, CEO, S&P Global Inc

Domestic Economy

“As we sit before you today, we are facing the most positive economic conditions that we have seen in the six years this [senate] committee has been enquiring into the major banks”

Shayne Elliott, CEO, Australia & New Zealand Banking Group Ltd

Supply & Logistics

“We are seeing in ports around the world there’s a lot of constraint. Constraint and rising activity create one thing and that is inflationary pressures, and we are seeing that. Pretty nominal impact to the first quarter [of 2021], we do anticipate seeing a larger impact as we move into Q2 and Q3”

Dan Florness, CEO, Fastenal Company [multinational distributor of industrial, safety and construction supplies]

“We have been able to continue to supply customers with product despite tightness in raw material supply and disruptions in ocean freight capacity which has resulted in an increase in transportation transit times”

Market Statement, Ansell Ltd

“Growth in our non-aviation commercial sectors has also contributed to strong diesel sales, and we are beginning to see recovery in domestic aviation sales as domestic travel resumes”

Scott Wyatt, CEO, Viva Energy Group Ltd

Construction & Infrastructure

“The Australian Government’s economic recovery plan includes substantial investments in infrastructure construction. Spending on major projects in Australia is expected to average around $30 billion per year for the coming years”

Juan Santamaria, CEO, CIMIC Group Ltd

“BlueScope is a very different type of steel company and is in a compelling position to take advantage of emerging trends, such as demand for lower density and regional housing and for e-commerce and logistics infrastructure”

Mark Vassella, CEO, BlueScope Steel Ltd

“Investors have begun to return to the [residential] market, primarily focused on masterplanned communities but demand is also gathering pace in the apartment markets”

Susan Lloyd Hurwitz, CEO, Mirvac Group

Residential Property & Households

“[Industry is] looking beyond this JobKeeper and HomeBuilder period and seeing that the normalisation of population growth [through immigration] needs to be addressed and, at the moment, the timelines around international borders is very unclear”

Ken Morrison, CEO, Property Council of Australia

“We expect house prices to continue to grow through this year and next but not at the rapid levels we have seen in the first two months of the year”

Matt Comyn, CEO, Commonwealth Bank of Australia Ltd

“In some cultures where there was a longstanding do-it-for-me preference, we are seeing a new mindset emerge. COVID has created an environment in which people have not wanted to invite professionals into their homes. Therefore, to fix something in the home, one must do it themselves. We believe this trend has created a DIY tipping point in many markets and cultures around the world”

Steve Brass, COO, WD-40 Company

Consumer Spending & Retail + E-commerce

“Consumer excitement and optimism is returning in ways it hasn’t since well before the pandemic, and we’re seeing a denim resurgence as more people are going out”

Chip Bergh, CEO, Levi Strauss & Co.

“Customers complete 28% of purchases on Amazon in three minutes or less, and half of all purchases are finished in less than 15 minutes. Compare that to the typical shopping trip to a physical store – driving, parking, searching store aisles, waiting in the checkout line, finding your car, and driving home. Research suggests the typical physical store trip takes about an hour”

Jeff Bezos, outgoing CEO/Founder, Amazon Inc

“You only need to look at the US to see how the e-commerce market is playing out, and why we remain bullish about the shift from offline to online. We are at the start of this once in a generation shift”

Mark Coulter, CEO, Temple & Webster Ltd

“Small business and consumer sellers are thriving”

Jamie Iannone, CEO, eBay Inc

“I think more and more, especially in younger generations are interested in the re-commerce of pre-loved items and so it’s why we’re leaning in so much towards that”

Jamie Iannone, CEO, eBay Inc

Food & Beverage

“We’re seeing this unique period where there is both a continuance of that at-home consumer behaviour, as well as increasing away-from-home behaviour”

Michele Buck, CEO, The Hershey Company [one of the largest chocolate manufacturers in the world]

“We are seeing overall that some of the changes that [have] happened with consumers through this pandemic, like doing more delivery, like going through drive-thru, those we expect are going to be enduring”

Chris Kempczinski, CEO, McDonald’s Corporation

Travel, Leisure & Transport

“Corporate travel, including the small business segment, is now back to around 65 per cent of pre-COVID levels, and increasing month-on-month”

Alan Joyce, CEO, Qantas Airways Ltd

“The current environment is characterised by extremely strong leisure demand – helped by the Federal Government’s half-price fare offer”

Company Announcement, Qantas Airways Ltd

“The change we’ve actually seen is more people driving private transport and not using public transport”

Robbie Blau, CEO, SG Fleet Ltd

Automotive & Microchip shortage

“Typically, carmakers will go for the latest and greatest [technology]”

Harold Goddijn, CEO, TomTom N.V.

“I would suspect we’ll see this sort of [automotive market] buoyancy for a while yet but then we may see things start to contract marginally towards the end of the year”

Mark Weaver, CEO, Peter Warren Automotive Holdings Group

“We are missing the most simple of chips that maybe only cost cents or dollars. That’s holding us up from building a product that costs $US75,000”

Ola Kallenius, CEO, The Daimler Group [owner of Mercedes-Benz & worlds largest commercial vehicle manufacturer]

“We’ve had some of the most difficult supply-chain challenges that we’ve ever experienced in the life of Tesla”

Elon Musk, CEO, Tesla Inc

Energy & Resources

“What’s fundamentally changed now is the capital discipline in the [LNG] industry that wasn’t there before and obviously the focus on climate change…It’s gone from being almost an industry that were [climate change] deniers to an industry that has accepted we need to be part of the change”

Peter Coleman, CEO, Woodside Petroleum Ltd

“The high iron ore price won’t last, given other lower cost countries with huge resources, and huge higher-grade resources, will come into production in future”

Market Statement, Roy Hill [Hancock Prospecting’s WA iron ore mine]

“We are talking with a number of miners about building their own 5G private network on a mine location where they can provide connectivity. They do that…because to try and automate the mine with robotics they need sensors infused in everything, but that then needs to be communicated”

Andy Penn, CEO, Telstra Corporation Ltd

“Favourable commodity prices support higher CapEx [capital expenditure] for mining customers. We continue to feel optimistic about mining”

Jim Umpleby, CEO, Caterpillar Inc

Environmental, Social & Governance

“Climate change risks are deeply imbedded in the financial system and impact all sectors and asset classes”

Louise Davidson, CEO, The Australian Council of Superannuation Investors [industry body for ESG issues of superfunds & institutional investors]

“Distinctions between the corporate brand and the consumer brand are blurry. They are now two sides of the same coin and you can’t build an inclusive family focused global consumer brand like McDonald’s unless the corporations actions give evidence to those attributes”

Chris Kempczinski, CEO, McDonald’s Corporation

More updates on the market and purchase entries for members follow below.