The market is attempting a recovery in the latter half of March, heading back over the 6,800 mark and staying there.

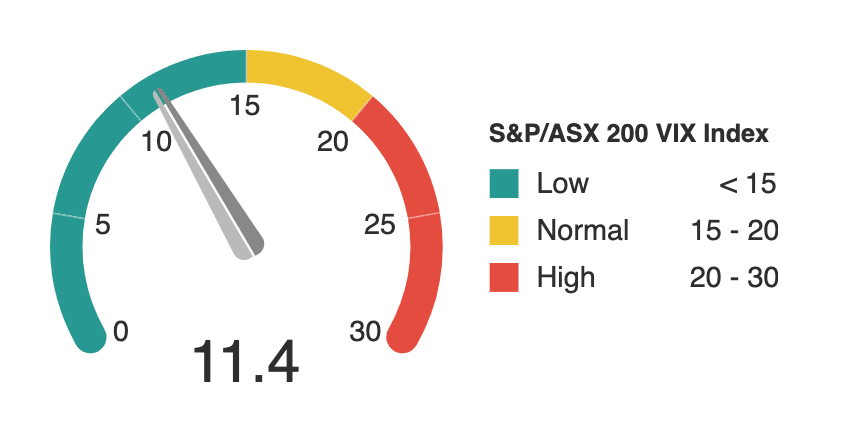

The ASX VIX (volatility index) has dropped down from around 13 to 11 this month.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

CEO Insights

Domestic Economy & JobKeeper

“For inflation to be sustainably within the 2 to 3 per cent target range, wages growth needs to be materially higher than it is currently. This is the basis for our assessment that the cash rate is very likely to remain at its current level until at least 2024”

Dr Philip Lowe, Governor, Reserve Bank of Australia

“There has never been a time where there has been such enormous disruption of industries, technology change, changes to consumer behaviours and ways of working”

Rob Scott, CEO, Wesfarmers Ltd

“The reality is that the so-called [post JobKeeper] cliff that we all feared is a very, very shallow cliff, if at all”

Shayne Elliott, CEO, ANZ Bank Group Ltd

“It feels like customers are becoming more prudent in terms of their spending – we’ve definitely seen that change in the last month”

Andre Reich, CEO, The Reject Shop Ltd

“As confidence builds the savings rate will reduce to more normal levels, which will be another retail stimulus effect dropping into the economy”

Ian Bailey, MD, Kmart Group

Global Economy

“At the Fed [Federal Reserve], we will continue to provide the economy the support that it needs for as long as it takes”

Jay Powell, Chair, US Federal Reserve

“We’re also seeing an increasing tailwind from inflation, which started in commodities, but is now flowing through in the finished goods due to rising input, manufacturing, and transportation costs”

Kevin Murphy, CEO, Ferguson plc [multinational plumbing/heating product company]

Global Semiconductor Chip Supply Crisis

“We’re seeing some constraints in the semiconductor supply chain. It’s impacting global automotive. The build rates have been rolled down from where we thought we would be as we entered into the year. We’re seeing that connection between electronics and automotive ever more impactful”

Mike Roman, CEO, 3M Company [global industrial conglomerate]

“The digital-first world, everybody talked about the trends that accelerated in 2020. The digital-first world [has] put a big increase in demand as we’ve seen on semiconductor fabrication”

“There’s a serious imbalance in supply and demand of chips in the IT sector globally”

Koh Dong-jin, Co-CEO, Samsung Electronics

“We expect the situation to become critical during the second quarter and have therefore decided to take measures [reducing car production]”

Market Statement, The Volvo Group

Technology & Telecommunications

“Today the data centre industry is supporting an enormous boom in technology and information creation, all of which are powered by computers and global networks that consume significant amounts of electricity”

Craig Scroggie, CEO, NextDC Ltd

“Our ageing [national fibre] infrastructure isn’t really designed for where the world is going. When these were built, the cloud and Space X weren’t around”

Bevan Slattery, Founder, HyperOne/Megaport/NextDC/PIPE Networks/Superloop

“Even as we can now see the other side of the pandemic – people have learned behaviours of the new digital world. It’s work from anywhere, do from anywhere – that world is here to stay. I believe the available opportunity for us is expanding”

Michael Dell, CEO, Dell Technologies Inc

Automotive

“Within 2 life cycles the car industry will change dramatically, radically. Profit pools will shift from conventional cars, first into EVs [electric vehicles] and then radically into software. That has a lot to do with automated driving, which is going to happen”

Herbert Diess, CEO, Volkswagen AG

“Technology companies entering the car industry means that the car industry has a future and choices for customers will widen”

Akio Toyoda, CEO, Toyota Motor Corporation

“2021 is the tipping point toward EVs [electric vehicles]”

Mark Reuss, President, General Motors Company

Healthcare

“Technology is rapidly going to disrupt the [healthcare] industry which has been really hard to change”

Tom Seymour, CEO, PwC Australia

Energy & Resources

“All of us in the resources sector, including our colleagues in the coal industry, know that [environmental] change is coming”

Andrew Forrest, Chairman, Fortescue Metals Group Ltd

“We haven’t seen any change in our relationship with our customers. We are seeing ongoing strength in demand”

Elizabeth Gaines, CEO, Fortescue Metals Group Ltd

Commercial Property

“We’re seeing rents come down but it’s not a material number at this stage. As we get through the latter half of this year, vacancy rates will probably increase in shopping centres, so rental deals will become better”

Andre Reich, CEO, The Reject Shop Ltd

Housing & Construction

“Everybody’s expecting a boom and so, if there is a boom, that’s when subcontractors’ and suppliers’ prices rise. If you go in really cheap now and activity picks up, you’ll lose money. The subcontractors and supplier prices will go up”

Scott Hutchinson, Chairman, Hutchinson Builders [one of Australia’s largest privately owned construction companies]

“Given the profile of work we now see in front of us, especially in the key civil infrastructure markets on the east coast and particularly in Queensland, and across various industries including rail, road, energy, water and defence, we are very confident that earnings will continue to grow at a strong rate in the coming years”

Steven Boland, CEO, Acrow Formwork & Construction Services Ltd [national formwork/scaffolding company]

“The housing stimulus has created more demand than ever, it’s absolutely unprecedented. Builders are all fighting over a limited number of subcontractors and now are more worried about securing enough tradies to deliver the projects, than winning more work”

Russ Stephens, CEO, Association of Professional Builders

Retail

“Last year, we suddenly discovered a number: $60 billion – which is money that Australians spend overseas. I think most retailers will never ever forget that number again. Whilst we feel for international tourism operators…while Australians can’t travel, the harsh reality is that money is staying in Australia and with low-interest rates being pretty good for the property market…[this has been] very good for retail.”

Richard Murray, CEO, JB Hi-Fi Ltd

“Safety and hygiene are here to stay – we’ll be selling a lot of hand sanitiser for many years to come”

Sarah Hunter, Managing Director, Officeworks

“Beauty is a habit-forming, high frequency purchase – our customers see beauty shopping as essential not discretionary”

Tennealle O’Shannessy, CEO, Adore Beauty Group Ltd

E-Commerce

“It’s a long-term trend that’s been accelerated in the last year, but it’s early days for e-commerce”

Dhivya Suryadevara, CFO, Stripe [US$95bn global payment processing software company]

Financial Markets

“There is no question that digitisation and technology is expanding access, and the expansion of that access breeds more participation [in equity markets]”

David Solomon, CEO, Goldman Sachs Inc

Food & Beverage

[Due to eating more at home] “We are seeing no shortage of [butter] demand”

Rene Dedoncker, MD, Fonterra Australia

Travel & Leisure

“We’re seeing an improving trend in forward bookings across the globe”

Kyle Gendreau, CEO, Samsonite International S.A. [world’s biggest luggage manufacturer & retailer]

“I don’t want to talk about hearsay or the feedback we get, but I would not expect it to be realistic that more than 30-50 per cent of people [would be] vaccinated in the western world before [the northern hemisphere] summer next year”

Detlef Trefzger, CEO, Kuehne+Nagel International AG [world’s 2nd largest freight company/major vaccine distributor]

“Regions that haven’t been able to snare the ‘drive market’ are now down by about 40 per cent year-on-year for forward bookings, according to our 1200 members across the nation”

Simon Westaway, Executive Director, Australian Industry Tourism Council

“Strong social distancing rules are still in place within the community; the vaccine rollout remains in its infant stages; our international border is still slammed shut, and local consumer confidence has been rocked by ongoing rolling state border closures. Until those four blockages are removed, the industry is in dire trouble”

Simon McGrath, CEO, Accor Hotels Australia

Manufacturing

“The next really ‘holy grail’ in textiles will be recycling… I believe that for this industry, it’s unacceptable that we don’t have proper recycling solutions, something a bit more comparable towards what the paper, steel, aluminium [industries] have”

Stefan Doboczky, CEO, The Lenzing Group [global textile manufacturer]

“Labour is very expensive in this country. You need to make premium products that people want to pay for and ensure that you are manufacturing in a smart way”

Darren O’Brien, CEO, Mondelez Australia [world’s 2nd largest snack food company]

Education & Learning

“A growing global middle class and longer careers are driving lifelong and non-academic learning, particularly re[skilling] and upskilling, a trend that has been accelerated over the past year. This all adds up to a huge momentum in our industry”

Andy Bird, CEO, Pearson Publishing PLC [multinational publishing & education company]

Workplace & Employment

“The gap between employment and learning is narrowing. Employers are becoming the universities of the future”

Andy Bird, CEO, Pearson Publishing PLC [multinational publishing & education company]

“We don’t see anybody just saying, okay, we’re not sending you any new boxes…it is very steady in the business, if that someone sends us a box today, it will sit there for 15 years on average, that [tenure of box retention] has not changed during COVID, it didn’t change before COVID”

William Meaney, CEO, Iron Mountain Inc [multinational document storage company]

“What Australia lacks is not the [tech sector workforce] talent, just the experience. When you are creating global platforms, getting the experience level in the country is a real key enabler”

Anthony Eisen, Co-CEO, Afterpay Ltd

“I think you’re going to see a large creation of an onshore-centre-type workforce in this country in places like Adelaide, where you can get a labour arbitrage. You’re going to see a distribution of the workforce differently. COVID allowed us to do that”

Tom Seymour, CEO, PwC Australia

More updates and purchase entries for members follow.