March started well before fading away toward the end of week 2 and rallying on the last Friday. Remember, this is after a week or so of turbulence and correction especially in the technology sector both locally and in the US.

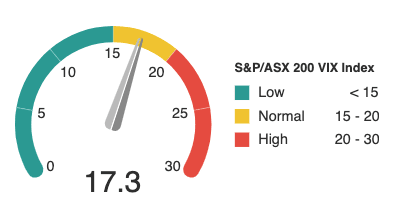

The ASX VIX (volatility index) had crept back up, now just over 17.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

CEO Insights

Domestic Economy

“Australia is relatively well positioned having started from a position of fiscal and economic strength. We have a solid pipeline of infrastructure projects, the outlook of mining and agriculture exports is strong, and the community has benefited from the Governments significant income support measures”

Matt Comyn, CEO, Commonwealth Bank of Australia Ltd

“The economy is recovering, consumer and business confidence is strong, and the labour market has been much more resilient than expected. At the end of December there were 12.9 million employed Australians compared to 13 million in March 2020”

Peter King, CEO, Westpac Banking Corporation

“Economic conditions in Australia have recovered strongly and the outlook is more positive”

Rob Scott, CEO, Wesfarmers Ltd

Mining, Resources & Commodities

“Global steel demand exceeded expectations with record crude steel production in China, as well as robust global recovery”

Market Statement, Fortescue Metals Group Ltd

“The outlook for Australian iron ore investment [is] particularly solid. Ongoing capital and operating expenditure required to sustain the high levels of production in this sector will drive strong and steady demand for engineering construction and maintenance services”

Market Statement, Monadelphous Group Ltd

“Record inflows in gold ETF’s indicates the strength of investor demand at a time of heightened risk & uncertainty, ultra-low interest rates, fiscal expansion and economic shutdown”

Market Statement, Newcrest Mining Ltd

“The Commodities division, particularly Geochemistry, demonstrated a significant improvement in performance late in the second quarter which [has] continued into the third quarter of FY21”

Raj Naran, CEO, ALS Ltd

“Commercial businesses, excluding aviation, to remain robust with potential to benefit from the gradual recovery in aviation and cruise segments”

Market Statement, Viva Energy Australia Ltd

Construction & Infrastructure

“Our Industrial Services portfolio is benefitting from accelerating mining production and economic stimulus measures to generate building and infrastructure activity”

Ryan Stokes, CEO, Seven Group Holdings Ltd

“Based on the continued, strong momentum in its business and expectations for continued growth in residential end markets, the Company is raising its outlook for fiscal year 2021”

Market Statement, James Hardie Industries plc

“Whilst a challenging environment continues for construction of retail, office and accommodation projects, health and industrial construction remains positive, along with the long pipeline of large-scale civil projects”

Market Statement, Big River Industries.

Commercial Property

“The impact on office demand is not clear, though it is likely to result in some reduction. However, this is expected to be most pronounced for older, secondary grade product as firms seek to upgrade to modern, highly sustainable spaces integrated with smart technology that enables them to seek efficiencies with their occupancies”

Susan Lloyd-Hurwitz, CEO, Mirvac Group

“Strong demand from the digital economy continues to drive enduring change, sustaining activity and property fundamentals for our business”

Market Statement, Goodman Group

Residential Property

“Cashed up homeowners, many of whom are prevented from travelling either domestically and internationally, are now largely working from home and as such, are reassessing their lifestyle and surroundings. This is positive for our industry as it results in homeowners either transacting or improving the asset value of their current home”

Eddie Law, CEO, McGrath Ltd

“Australia’s property market appears to be on the march again”

Owen Wilson, CEO, REA Group Ltd

Retail

“I’ve been doing retail since the late 1950s and I’ve never seen anything like this. We’ve seen ups and downs and recessions but retail in Australia has never seen this… That’s happening right across the world, it hasn’t stopped. In April, May and June, sales went through the roof and it hasn’t stopped in January and February”

Gerry Harvey, Chairman, Harvey Norman Holdings Ltd

“Regional and suburban stores [sales] were relatively strong”

John King, CEO, Myer Holdings Ltd

“Spectacular sales growth throughout all states”

Market Statement, Beacon Lighting Group Ltd

“Households have accrued a large stock of savings through 2020 due to periods of restrictions, and fiscal and monetary stimulus. Together with an improving employment market and evidence of growth in wages and salaries, prospects for continued recovery in retail consumption are expected”

Susan Lloyd-Hurwitz, CEO, Mirvac Group

Transport, Logistics & Supply

“The huge drop in international passenger flights has created a huge shortage in the cargo capacity that goes with them – meaning the value of freighter space has surged”

Alan Joyce, CEO, Qantas Group Ltd

“Global supply chains are under pressure to meet increasing consumer requirements and higher utilisation”

Market Statement, Goodman Group

“Supply chain delays make it difficult to accurately predict sales revenue growth for the second half”

Anthony Scali, CEO, Nick Scali Ltd

Automotive

“COVID-19 [is] driving unprecedented fluctuations in market conditions”

Market Statement, Eagers Automotive Ltd

“Demand for vehicles across all our markets has been strong due to lower public transport usage, the absence of international travel and the evolution of more flexible working arrangements”

Cameron McIntyre, CEO, Carsales.Com Ltd

“Vehicle supply expected to return to market in 4Q21 with normalisation of retail pricing”

Market Statement, McMillan Shakespeare Ltd

Travel & Leisure

“Based on what we have seen so far, travellers have been keen to take off as soon as they have been allowed to do so, which should ultimately lead to a very solid rebound”

Graham Turner, CEO, Flight Centre Travel Group Ltd

“This [travel returning to normal] isn’t some far away dream. It’s what we’re heading towards and it’s what we will get to in the next 12 – 18 months”

Andrew Burnes, CEO, Helloworld Travel Ltd

Media & Advertising

“The advertising market clearly turned in late September, earlier and more sharply than we had anticipated, and this was led by television… The advertising market continues to show strength, with television in particular benefiting from a shift to ‘brand’ by major advertisers”

Hugh Marks, CEO, Nine Entertainment Co

“Revenue has recovered strongly”

Market Statement, oOh! Media Ltd

Technology & Telecommunications

“We saw an unprecedented spike in demand for [cybersecurity] devices throughout 2020 and expect this to continue this year. We are anticipating a high level of growth in automation, machine learning and data capture and analysis tools as businesses and governments prioritise efficiency and productivity within their operations”

David Dicker, CEO, Dicker Data Ltd

Healthcare & Aged Care

“Surgical backlogs and latent demand for non-surgical services are expected to drive volumes as the general public’s comfort with the hospital environment improves.”

Market Statement, Ramsay Health Care Ltd

“One sector where we have seen digitisation accelerate dramatically is, of course, in healthcare technologies”

Andy Penn, CEO, Telstra Corporation Ltd

“Inadequate Commonwealth Government funding and prevailing uncertainty across the [aged care] sector needs to be urgently addressed in order to ensure provider viability and build adequate capacity for the future”

Linda Mellors, CEO, Regis Healthcare Ltd

“In many parts of the world, we have continued to see an influx of COVID-19 patients requiring hospitalisation for respiratory treatment. Healthcare professionals are dealing with pressures unlike anything they have faced before”

Lewis Gradon, CEO, Fisher & Paykel Healthcare Ltd

Consumer Staples

“Sales for all Group businesses [except Hotels] are expected to decline in March to June compared to the prior year as we cycle COVID sales surge”

Brad Banducci, CEO, Woolworths Group

“Convenience store sales growth was also strong as Coles Express continued to benefit from the shift in customer behaviour towards the convenience channel and avoiding larger, busier stores”

Market Statement, Coles Group Ltd

Agriculture & Food

“Favourable weather conditions and recently firming fertilisers prices are expected to drive higher earnings in FY21”

Market Statement, Incitec Pivot Ltd

“We experienced near optimal conditions across much of eastern Australia during the recent winter cropping season and this has translated into one of the largest crops in recent history”

Robert Spurway, CEO, GrainCorp Ltd

“Inflation in red meat also continued in the second quarter with cattle prices at record highs”

Market Statement, Coles Group Ltd

“Many restaurants remain closed or are having to adapt to reduced volumes and it will likely be some time before we see the food service sector return to normal”

Hugh Killen, CEO, Australian Agricultural Company Ltd

“The increased consumer activity in these [domestic] markets is expected to deliver long term benefits through increased per capita consumption with more consumers now familiar with salmon as a weekly family menu item”

Peter Bender, CEO, Huon Aquaculture Group Ltd

More updates on the market and purchase entries for members follow below.