Global markets, especially in the US and here are at record highs.

The ASX 200 (XJO) briefly touched 7,610 yesterday before finishing around 7,500.

In the short term we’re seeing a lot of companies also at highs and priced above they’re moving averages. Higher valuations mean they are more sensitive and prone to corrections on any news perceived to be negative by the market. It tends to be more pronounced in companies with smaller market capitalisation.

Companies continue to release quarterly updates. August / moving into early September every year, seasonally tends to be a weaker period.

A correction is coming, not one to be alarmed about for long term investors. They are healthy and return markets back to fair valuations and provide buying opportunities.

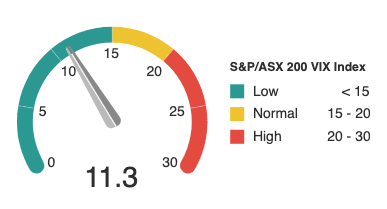

The ASX VIX (volatility index) has fallen to under 12.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

CEO Insights

Consumer Behaviour

“There are two drivers behind this [battery category] growth. Devices owned per household are up mid-single-digits…and an increase in the amount of time those devices are being used. As a result, consumers are replacing batteries more frequently”

Mark LaVigne, CEO, Energizer Holdings Inc

Mining & Resources

“I feel our industry is still too fragmented and needs to lift its horizon and focus a little more on the future. We have been living on a rising gold price going back to the turn of the century with not much focus on replacing the ore bodies we mine with similar quality”

Dennis Bristow, CEO, Barrick Gold Corp Inc

Travel & Outdoors

“We are, of course, closely monitoring the impact of the Delta variant on the rising COVID case counts around the world as well as some newly imposed travel restrictions, which have led to a modest pullback in our booking trends in the month of July relative to June”

Glenn Fogel, Booking Holdings Inc

“Right at the beginning of COVID, in February of 2020, I think I said when I was asked “Our inventory levels have been very stressed this whole season just because the demand is high”

Helen Johnson-Leipold, CEO, Johnson Outdoors, Inc. [fishing, diving, camping & watercraft conglomerate]

“Fortunately, experience has shown us that traffic rebounds quickly when restrictions are lifted although the rate of recovery depends on the length and nature of ongoing restrictions”

Scott Charlton, CEO, Transurban Ltd

Transport & Logistics

“You’ve got this huge increase in global steel prices, you’ve got these huge increases in shipping costs, you’ve got congestion at the wharves…sometimes you can’t even get your product off the port overseas”

David Buchanan, CEO, Australian Steel Association

Automotive

“The currency that matters in our industry today is how large is a vehicle’s carbon footprint throughout the whole of its life cycle?”

Oliver Zipse, Chairman, BMW AG

“The visibility that we have in the automotive industry on the semiconductor supply is still quite poor”

Carlos Tavares, CEO, Stellantis NV [parent company of Fiat Chrysler/Peugeot Group]

“By 2025, three of every one hundred new vehicles sold is projected to be battery or plug-in hybrid electric”

Market Statement, GUD Holdings Ltd

Domestic Economy

“As the past 18 months have shown, Australia has a very strong, stable and secure financial system”

Matt Comyn, CEO, Commonwealth Bank of Australia Ltd

Inflation

“We have seen operating costs including labour, transportation, and commodities rise rapidly over past few months. This is a trend we expect to continue”

Mark LaVigne, CEO, Energizer Holdings Inc

“We have seen accelerating and unprecedented inflation”

Donnie King, CEO, Tyson Foods, Inc [world’s 2nd largest meat processor]

“What you saw historically, freight cost could have been as low as $2,000 a container, coming out of China today I’ve seen prices as high as $18,000 a container. So, you’re looking at a 900% increase in those costs…and I think it’s going to go on for a few quarters at least”

Selwyn Joffe, CEO, Motorcar Parts of America, Inc

E-Commerce

“The longer this pandemic goes, the more entrenched the way we’re living, [which] also means that we’re spending more online…and I think the world will be at 40% online sales through retail sooner than was forecast 12, 18 months ago”

Greg Goodman, CEO, Goodman Group

Technology

“But regardless of where a company is on the growth spectrum, we’re seeing the same response today. Those companies that enjoyed accelerated growth [during COVID] now need to market effectively to sustain that growth. Those that were struggling and hit the pause button are now playing catch up [and] aggressively marketing to make up for lost time”

Jeff Green, CEO, The Trade Desk Inc [world’s largest programmatic media buying platform]

Technology

“This increase [in mobile subscribers] is despite a decline in Australia’s population, a trend which is expected to continue to impact industry growth”

Andy Penn, CEO, Telstra Corporation Ltd

“We expect this [cloud communications] trend will continue long after the world reopens. This is because enterprises around the world now understand that, if they are to compete and win they need to offer a stellar customer experience. They need the quality, scalability and flexibility that can only be found in the cloud”

David Morken, CEO, Bandwidth Inc

“We now have many ambitious founders in Australia too, who have been very successful and, for me, that’s a really important part of creating that multiple generational industry, that you can start small and take on big audacious goals”

Robyn Denholm, Chairman, Technology Council of Australia & Tesla Inc

More updates on the market and highlights for members follow below.