Global markets, including the ASX have entered a corrective phase after a period of sideways movement. Renewed lockdowns in the US and growing case numbers locally and overseas are a factor.

The ASX 200 (XJO) briefly touched 7200 today and could retest the 7100 mark too.

Covid beneficiaries and defensive stocks in the consumer staples and healthcare sectors are expected to show some resilience relative to the wider market, with gains likely muted.

Companies planning to release guidance updates could see even the most positive updates drowned out by the selling pressure.

Whats the strategy and approach in this period for us? Read on to find out. Members can also see a 30 minute video from Fahd and Moin, below with most recent portfolio company news.

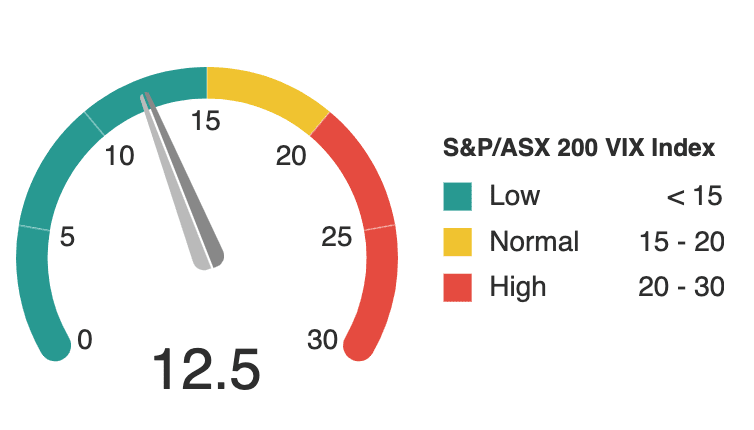

The ASX VIX (volatility index) has started to creep up and is over 12.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

CEO Insights

Consumer Behaviour

“We are optimistic about the long-term trends [of e-commerce and urban store formats] – we’re not planning a business for the long-term based on the last 12 to 15 months of COVID-19”

Tom Daunt, CEO, Aldi Australia

“We’re seeing the pendulum swing in consumer behaviour from the stockpiling and search demand for essentials in Q3 of last year to an increased demand for discretionary items this year”

Sherry Bahrambeygui, CEO, PriceSmart, Inc [multinational membership shopping operator]

“It is a sign of the times that you can place ads in newspapers, in shopping centres, online, on Seek, and pay all sorts of large amounts for that and there is just no response”

Warren Pearce, CEO, Association of Mining and Exploration Companies

“Spending on books is up double digits, maybe 15% and that’s true around the world…We’ve seen people turn to books as a form of entertainment, as an escape. People have gotten time back that they used to spend maybe commuting or traveling. There’s definitely this renaissance in book reading and book interest”

Brian Murray, CEO, HarperCollins Publishing LLC

Food & Beverage

“Demand for almonds, both in their natural form and as a value-added food ingredient, in products such as plant-based milks and yoghurts, continues to grow”

Paul Thompson, MD, Select Harvests Ltd

“I think the non-sugar portfolio is excellent and that’s the area of the [drinks] category that is growing the fastest”

Ramon Laguarta, CEO, PepsiCo Inc

Workplace & Employment

“Right at the beginning of COVID, in February of 2020, I think I said when I was asked how would this end up, I think I said that I felt 80% of all employee hours worked would be done in one of our offices, and that’s probably where it’s going to end up. Not 100%, but not 0%”

James Gorman, CEO, Morgan Stanley

Healthcare

“What we’re hearing from them [pharmacies] is that they are often overwhelmed trying to manage different health conditions, providers, appointments, bills and medication, all of which are on different platforms and channels…the overall healthcare space is sprawling and incredibly complicated”

Rosalind Brewer, CEO, Walgreen Boots Alliance Inc [global leader in retail pharmacy]

Automotive

“After 2035, you won’t be able to buy a new fossil fuel-powered car in Europe. That’s not far away, and the sheer scale of lithium that Europe will require to achieve that is just phenomenal”

Francis Wedin, CEO, Vulcan Energy Resources Ltd

Domestic Economy

“Among global investors Australia continues to be a highly attractive investment destination and we expect continued strength in investment demand for quality assets in the year ahead”

Darren Steinberg, CEO, Dexus

Technology

“The world is becoming digital, driven by four superpowers: cloud, connectivity 5G, artificial intelligence and the intelligent edge. I call these superpowers because each expands the impact of the others and, together, they are reshaping every aspect of our lives and work”

Patrick Gelsinger, CEO, Intel Corporation

“It’s simple. Businesses across every industry will adapt or they’ll perish and with $100 trillion flowing into the global economy, demand for digital infrastructure will continue to explode”

Charles Meyers, CEO, Equinix Inc [world’s largest colocation data centre provider]

“Pre-COVID our research showed a digital achievement gap with leaders growing 2x faster than laggers and we estimate that gap has now widened to 5x, with leaders stepping up their investment in technology and innovation, and lead progress taking accelerated steps to catch up”

Julie Sweet, CEO, Accenture plc

“Security is top of mind for our clients as the threat landscape expands”

“To some extent, there’s a gradual generational change that’s occurring inside companies, as the executives have a greater understanding of the role technology plays…But last year digital transformation really kicked into a whole other gear, and organisations figured out that the only thing that worked during the lockdowns was technology”

Michael Dell, CEO, Dell Technologies Inc

More updates on the market and highlights video for members follow below.