We have an on-going discussion on our premium forum about mid-term and short-term strategies, whether it’s something that’s possible or worth doing.

I think about and discuss it with Fahd from time to time. He has some experience with this and so did his father. Fahd and his portfolio team, in previous jobs, did some active investing while managing very large portfolios, where its best to trim positions, sell and lock in some profits etc. as things change in the markets Particularly because, with larger amounts of capital, you can’t just buy small and micro cap companies without causing huge volatility and spikes in prices, which defeats the purpose of buying low and holding.

Anyway, I have tried a short to mid term approach a few times in the past with some success, however the cons have always been enough to deter me from exploring it again seriously; namely:

- Time needed to spend in front of the screen monitoring charts for entries and exits (4 hours per day minimum)

- Tax implications with full capital gains counted as income to be taxed

- Time / admin needed to track and lodge tax returns with so many trades

- Brokerage costs adding up

We have written in-depth about the cons of short-term trading and how a long term approach sets us up to beat other approaches consistently.

When I compare returns from short-term approaches with our returns from longer term investing through compounding, which takes way less day-to-day time and effort, it just makes it a no-brainer that it suits us better.

Not to mention, we wouldn’t be able to dedicate time to Tabarruk and members if we spent half a day or more trying to day-trade.

That being said, for the right investor, with the right mindset, time and risk tolerance, it could be worth trying.

Case in point, my recent performance in the Strawman Classic, an 8-week virtual ASX stock picking competition. It finished last week, and I places 5th out of over 2,000 contestants. Fahd placed 34th.

Here is a run down of some of my thoughts from our experience and the strategy I used.

I am a fan of virtual portfolios and game based investing like the ASX game and Strawman Classic, especially for new investors and children to learn the basics and try things.

In my video interview with the founder of strawman.com, Andrew Page, he mentioned how I’d been part of the platform since June 2020. I didn’t know there would be a competition and was just playing around with the website and discussion format while researching features and premium forum plans for Tabarruk.

Strawman had a few constraints:

- A 20% maximum limit on any one company, i.e. out of a 100k, no more than 20k could be invested in any one company.

- Trading in the competition was not real-time. Any trades entered during market hours were matched and executed on the closing price of the company on that day. So any day-trading or intra-day trades was not possible.

- The winner would be the portfolio with the highest %age returns in 8 weeks (not $ value)

I bought a few companies with the $100,000 virtual money and forgot about it until an email arrived announcing the competition. I discussed it with Fahd, and we both thought why not attempt to try a slightly different strategy in the game and see what would happen. Fahd made an account for himself too. Fahd decided to go with a more mining and rare earth focus, I decided to stay fluid and mix the best of what sectors were in focus, like mining, biotech companies with binary milestones coming up etc.

We thought, at the very least we’d learn something, find some new companies, write or make a video about our experience.

The 8 week strategy we used was along these lines:

- Pick companies based on our normal framework including some from watchlist and pre-watchlist

- Shortlist to companies that had milestones expected in the next 8 weeks

- I couldn’t screen for 100% shariah compliance in all companies, but used Islamicly for a 1st pass

- I couldn’t spend the time to fully research all companies and picked some outliers that matched 1,2,3

- Every week, I reviewed the sectors and companies that came into focus

- I cut losers if their milestones had passed without growth

- I swapped out losers with new companies or increased positions in my winners

What eventuated was quite interesting. You can see my exact trades (20 in total) at https://strawman.com/whenuvius/trades.

A rundown and highlights of the 8 week period follows:

Before the competition began on October 19th, my 20k ADN holding had already grown and become about 25% of my folio.

Week 1,2 and 3

- The first few weeks, some tech stocks dominated and set up the leaderboard.

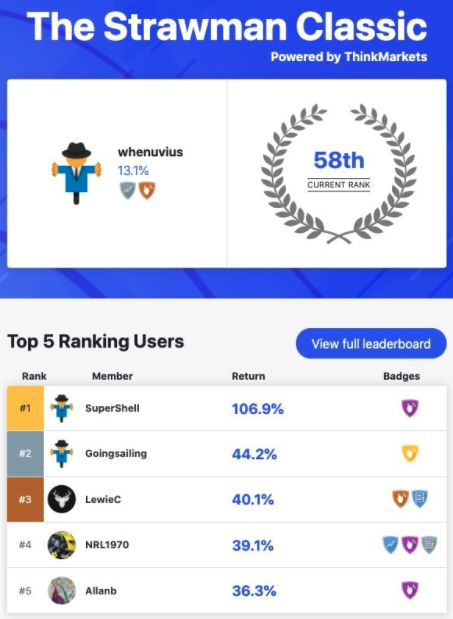

- Both Fahd and I ranked in the top 75 out of 2000 plus contestants.

Week 4 and 5

- ADN and IBX both had positive announcements causing huge growth

- I added a little MEP to my portfolio, which also followed ADN

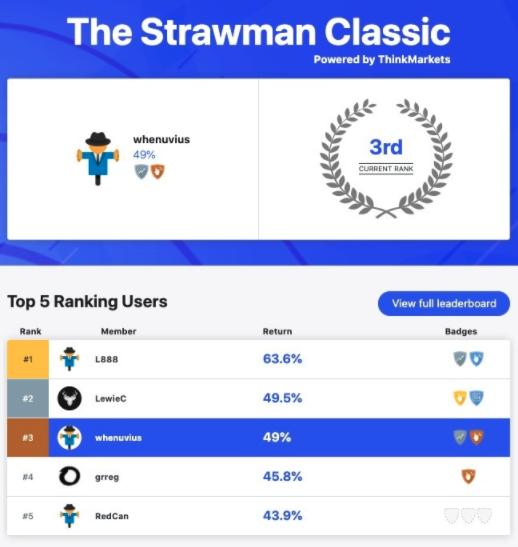

- I moved into 3rd place along with 3 other contestants who held ADN and MEP

Week 6

- ADN and MEP kept gaining, IBX gained too

- MSB has a positive announcement and surged 10%

- I moved to 2nd place about 9% behind 1st place

Week 7

- ADN and MEP started correcting, IBX held steady

- MSB had another positive announcement

- I attempted some swing trades with partial success

- The UN reclassified Cannabis, US bill passed to decriminalise marijuana, and a cannabis company CPH, got new orders for their produce and in the span of 6 trading days, rose 1000%, 10 bags. The sector in general pumped.

- I saw the sector start to pump, knew which companies looked ready to run, but obviously chose not to go there.

- Instead, I cut my non-performers and loss makers (including MEP) to pull out $14k and bought DVL, Dorsavi, a biotech motion analysis wearable tech product manufacturer with contracts and evaluations pending.

Week 8 – Final 5 days of trading

- The entire top 6 from the leaderboard of which most of us had ADN and MEP had shifter down to be replaced by a new top 5, all of whom held CPH, top 2 contestants with 200% and 180% returns.

- I dropped down to 11th place with 51% returns

- ADN, MEP and IBX all made slow gains

- MSB held steady

- With 3 days left, DVL announced an evaluation agreement with Medtronic, one of the largest medtech companies in the world.

- The market realised the next day, DVL rising 100%

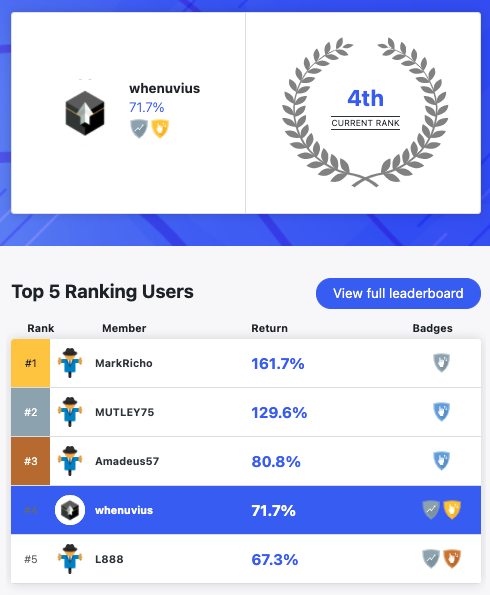

With 1 day left in the competition here’s how things stand:

- I am ranked 4th with 71.7% returns

- 1st place is 161.7% returns, followed by 129.6% for 2nd place and 80.8% for 3rd place

- All of the top 3 contestants have CPH and other cannabis stocks in their folios.

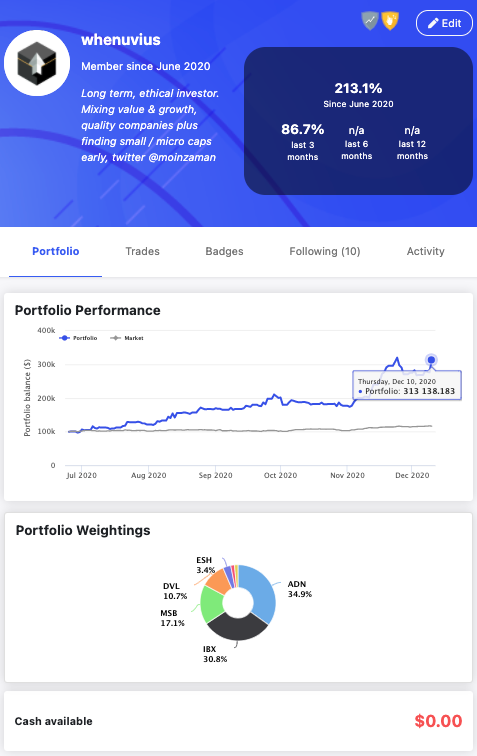

My portfolio in the game as of 10th Dec 2020

Things I did in game, that I’d rarely do for real

- Go ‘all in’, i.e. deploy all capital available to me

- Sell entire holdings of good companies for tiny amounts of profit

- Cut good companies just because they were not performing each week

Regardless of the outcome tomorrow, I’m humbled and proud to have not only featured in an interview on ausbiz, but also place high on a leaderboard where we could ‘compete’ and compare ourselves to peers, all while sticking to our principles and tailored strategy. Fahd ays that I have well and truly lived up to the title of being the best halal and ethical investor in the competition, and if it weren’t for the pot sector and CPH pump, I’d have most likely won.

I think he’s a touch biased 😉. The high risk, not fully researched, binary event dependent biotech companies, could have backfired on me. I mean, the two biotechs IBX and DVL didn’t even make it to our real watchlist or folios at Tabarruk. We may look into them a bit in our premium webinars and dig deeper if there’s serious long term potential.

To conclude, I see this performance in the competition, more as validation when we started Tabarruk, how we compared our past performance to similar players in the market and found that we were genuinely beating not just them and the market but other analysts, funds and investment gurus too. We felt confident that we were the best in our niche.

My starting portfolio value was $182,000.

My ending portfolio value after 8 weeks was $307,000.

Total profit of $125,000.

Total profit percentage was just short of 70%.

Side note on taxes in the real world

If this was the real world, assuming a yearly salary of $100,000, to realize my 8-week profit of almost 70% in full, I would’ve closed all my positions, and have all my capital gains counted as income, to be taxed $74,347, meaning I would take home about $50,000.

If I’d closed my positions, keeping all the other percentages the same, I would have only half of the profit counted as capital gains, meaning taxes would be $47,622, so I’d take home $78,000.

moin

moin