The September milestones continue. Both of us have had a few virtual high fives over zoom.

Our portfolio broke the $200,000 market value barrier one week after we crossed a net investment of $100,000 since we started the current portfolio in March 2020.

Purchase entry and update for members are at the end of this post.

The market has continued its sideways trend this month, albeit staying under 6000 points. A few corrections were triggered by volatility in the US and global markets, due to elections, second COVID wave concerns etc.

The other market recovery phenomenon we’re watching play out is a ‘K’ shaped recovery.

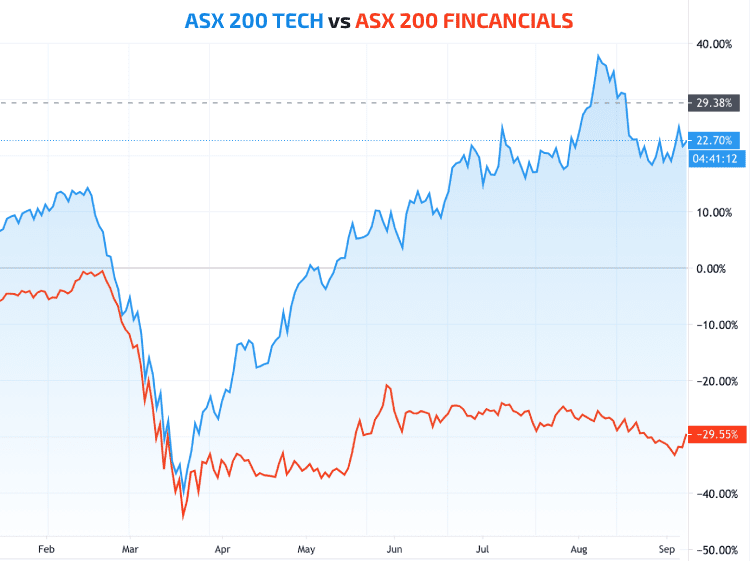

As an example look at the ASX 200 indexes for all tech companies vs financial sector since Feb 2020.

Some sectors have recovered, while others haven’t and may not for a while yet.

The difference in sectors that have recovered and those that haven’t, form a ‘K’ shape.

Similar comparisons can be made with sectors that haven’t recovered yet vs those that have, i.e. healthcare, mining etc.

The key to our success has been picking the right companies in the right sectors regularly as we see them, which will continue to be our plan.

On to the latest CEO insights.

CEO Insights

Technology

“What you’re also seeing in this economy is that the CEOs and the business line executives have realised that technology is the most important enabler for their business”

Michael Dell, CEO, Dell Technologies

“Today the internet connects billions of people to giant cloud data centres. In the future, trillions of devices will be connected to millions of data centres, creating a new internet of things [IOT] that is thousands of times bigger than today’s internet of people”

Jensen Huang, CEO, NVIDIA Corp [multinational graphics chip manufacturer]

Advertising & Marketing

“I would say that, if you look at the big tech companies, they’re all about now getting into media. If you look at the media companies, they’re trying to use new technologies like streaming and other platforms to distribute their content”

Brian Roberts, CEO, Comcast Corporation [telecommunications & media conglomerate]

Retail

“Pre-COVID, we projected that the US domestic market would hit 100 million packages per day by calendar year 2026. We now project that the US domestic parcel market will hit this mark by calendar year 2023, pulling volume projections forward by three years from the previous expectations. E-commerce fuelled substantially by this pandemic is driving the extraordinary growth”

Brie Carere, Chief Marketing Officer, FedEx Corporation

“A lot of the supplier shortages [of inventory] were predominantly around retailers believing their business was going to be severely impacted negatively by COVID and, taking out Victoria, that’s not what they saw. What we saw in fact was that business went through the roof in certain categories”

Paul Zahra, CEO, Australian Retailers Association

Automotive

“As this pandemic has rolled on people have been quite nervous to take public transport, and there has been an element of the public looking at used cars to maybe get a second car”

James Voortman, CEO, Australian Automotive Dealers Association

Energy & Resources

“Looking forward, we see a lower carbon technology as being essential. If anything, the changes over the last few months have accelerated the drive towards better, cleaner power solutions. The world is demanding cleaner energy”

Warren East, CEO, Rolls Royce Holdings Ltd

Transport & Logistics

“A key trend is the dramatic reduction of air cargo capacity as a result of the significant loss of commercial airline capacity. Current estimates indicate that freighter capacity now accounts for 66% of total air capacity on the Transatlantic lane; 83% on the Trans-Pacific; and 80% on the Europe to Asia lane. This compares to pre-COVID freighter capacity of 33% for Transatlantic; 59% for Trans-Pacific and 50% for Europe to Asia”

Brie Carere, Chief Marketing Officer, FedEx Corporation

Travel & Leisure

“One of the things that has clearly emerged is that there is more of a blending between business and leisure. So, whatever the phrase, I have heard “Bleisure”, knowing exactly what the bookings are, business or leisure, when they go from a Wednesday through a Sunday, is harder to define which that is”

Leeny Oberg, CFO, Marriott International Inc

“I do think there’s some real pent-up demand across all the segments of our business, and while that may not be sustainable forever, I do personally believe that there’s going to be a really nice spike in demand once everybody feels comfortable with traveling”

“Our view is demand is not coming back. People are not going to get back and travel like they did before until there’s a vaccine that’s been widely distributed and available to a large portion of the population”

Scott Kirby, CEO, United Airlines Inc

“It’s not going to be nearly the relatively fast recovery as we’d all hoped back in July when borders began to open. We’re definitely looking at four to five years at least until we really come out of this”

James Kavanagh, Managing Director Australia, Flight Centre Travel Group Ltd

Workforce & Employment

“I think the biggest take away from all the CEOs I talked to, that really to a CEO [they are] very worried about employee engagement right now”

Aneel Bhusri, CEO, Workday Inc [HR & finance global software company]

Payments & Banking

“What you would typically see in a recession is the savings rate fall. We’re actually seeing the savings rate increase and that’s because, we’ve seen spending go down, but we’ve seen discretionary income be flat or up in some cases”

Jen Piepszak, CFO, JP Morgan & Chase Co

“If more digital transactions are to be kept safe, more digital transactions also means more data that’s associated with those transactions is available, so we see a trend for more demand for data analytics and for cybersecurity solutions”

Michael Miebach, CEO, Mastercard Inc

“We’ve all seen a general trend in payments towards this concept of buying now and paying later and, for us, this [creating a BNPL product] is very much a way to capture additional share of checkout. This is something that helps drive additional sales for merchants. You tend to see the average order value be larger, and it creates more customer loyalty as well”

John Rainey, CFO, PayPal Holdings Inc

Commercial Property

“It’s going to be a couple of years to see the full impact on the market. We are going to have weak office demand and we’ve been very upfront about it”

Darren Steinberg, CEO, Dexus.

“Our view is that the hub-and-spoke model will be about flexibility, so if you are going to ‘spoke’ you’ll do it from home. Hubs are expensive to operate. In fact, in a recession, people are going to be very dollar conscious and so why would they disband a major head office, where they get great economies of scale, and instead open up all of these hubs?”

Darren Steinberg, CEO, Dexus.

Residential Property

“I do think we are seeing a change in the social fabric. I expect property prices in regional centres to grow and grow strongly. A million bucks doesn’t buy you much in Sydney and Melbourne”

Steve Laidlaw, CEO, People’s Choice Credit Union [one of Australia’s largest credit unions]

Members only updates follow below with purchase entries and company updates.