A flat week on the markets with 6,700 continuing to act as a key level.

Key headlines:

- Biden expected to reveal COVID relief package details tonight

- Early trial data points to Johnson & Johnson’s COVID vaccine being safe and effective in the short term. Long term data will also be studied.

- 2 new variants of COVID being studied

- 10 million people have received a COVID vaccine so far in the US

- Chinese exports see more than expected growth in December

- Shipping rates rise slowing parts of global economy, countering Asia’s trade-led recovery

- Japan’s machinery orders rise unexpectedly in November, 2nd straight monthly increase

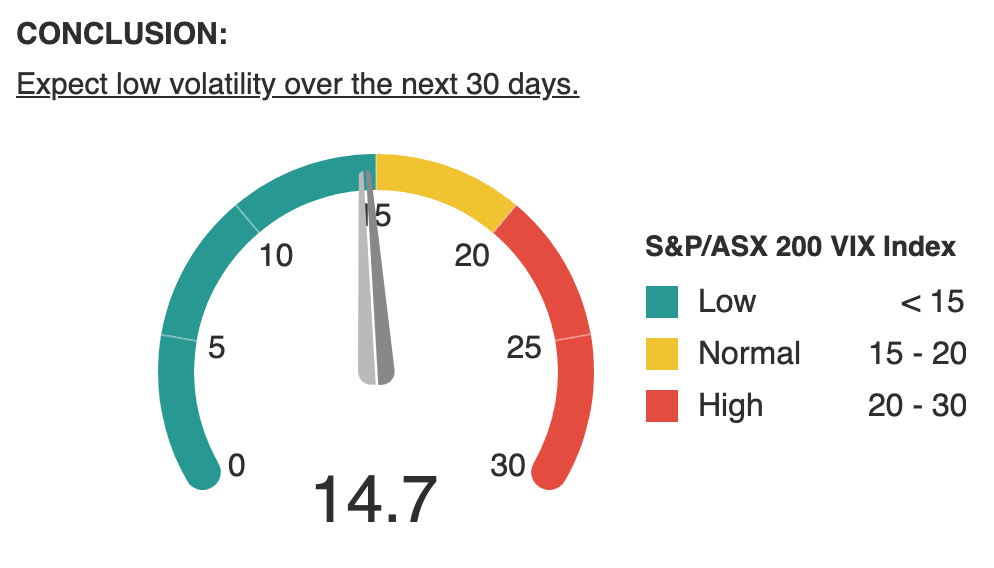

The ASX VIX (volatility index) continues to remain just under 15.

Volatility doesn’t necessarily show market direction (up or down) but the range of average price changes over time.

The S&P/ASX 200 VIX Index (XVI) calculates the amount of volatility expected in the market over the next 30 days.

• High readings indicate uncertainty (bearish)

• Normal readings suggest a slight bullish bias

• Low readings indicate low volatility (bullish) and strong investor confidence.

Purchase entries for members are at the bottom of this update.

On to the latest CEO insights.

CEO Insights by Sector

Travel & Leisure

“The number of cars out on the road, and the congestion, has come back real quick”

Darryl Abotomey, CEO, Bapcor Ltd

“I think the China market is the biggest global opportunity in the entire [mountain resort] industry and all the moves that we make for the company strategically are oriented around making sure that we can get benefit from that trend”

Rob Katz, CEO, Vail Resorts Inc

“I think we’re seeing very strong demand for resort properties and a lot of transactions, in many ways probably the strongest demand we’ve seen since 2008 or 2007 and I think, people are looking for opportunities to be critically outside of many of the big cities because of COVID”

Aviation

“It’s going to be super competitive [in the market] because we’re all rebuilding the market [after COVID-19]. It will never have been cheaper to travel in this country”

Jane Hrdlicka, CEO, Virgin Australia Airlines

Automotive

“We’re seeing rising steel prices in the U.S. and EMEA due to supply and demand imbalance. This has been caused by faster auto production recovery than anticipated and supply stock replenishment, which is currently outpacing industry steel supply levels as blast furnaces restart”

Peter Watson, CEO, Greif Inc [multinational industrial packaging company]

Technology

“The way we work will never be the same again and it’s great to see how the PC [personal computer] has experienced a tremendous revival as the computing workhorse…paper to digital transformation is only accelerating, and every business process is going digital because every business is now a digital business”

Shantanu Narayen, CEO, Adobe Inc

“I almost feel bad saying, maybe it [COVID] helped ultimately because many of our customers have realized the importance of using technology to deal with their customers, their employees, and their suppliers”

Safra Catz, CEO, Oracle Corporation

Healthcare

“Even regulated industries that have traditionally been slower to embrace digital have certainly picked up the pace this year. We have industries like healthcare that are transforming, whether it’s through personalised medicine, telehealth and new ways, frankly, to engage patients”

Shantanu Narayen, CEO, Adobe Inc

“I think this horrible COVID thing will shrink to insignificance in a year. They will get vaccines out so fast it will make your head spin. I watched the death of polio to vaccines too”

Charlie Munger, Vice Chairman, Berkshire Hathaway

Media & Advertising

“Ooh [Media Ltd] is well positioned to leverage the ongoing recovery in audience growth and advertiser sentiment which is becoming increasingly evident”

Brendon Cook, CEO, Ooh Media Ltd

“The media agency market spend, as measured by SMI [Standard Media Index], reached a low point for the year in May 2020 and has improved considerably since that time with November data showing a return to growth after 26 months”

Market Announcement, WPP AU NZ Ltd

Retail

“With the inflections that we’ve seen this year through COVID with guests [our customers] living a more active, healthy life and looking for more versatility in their apparel clothing, I think that all bodes well for the addressable market”

Calvin McDonald, CEO, lululemon athletica inc.

“I still think brick-and-mortar is not going to go away”

Craig Jelinek, CEO, Costco Corporation

Global Economy

“We’re in a global recession, that will most likely for the most part continue in 2021”

Mark Schneider, CEO, Nestlé S. A.

Equity & Financial Markets

“We are mindful that very low interest rates result in further asset appreciation; however, in the near term the risk of not stimulating the economy is greater”

Shemara Wikramanayake, CEO, Macquarie Group Ltd

“There’s a lot of retail participation in a bunch of these IPOs. I do think we’re at a moment in time where there’s a lot of euphoria. I personally am concerned about that. I don’t think in the long run that’s healthy”

David Solomon, CEO, Goldman Sachs Inc

“Financial markets are telling us that the growth and inflation outlook is benign, which supports governments’ capacity to acquire more debt for the foreseeable future, as long as interest rates are lower than trend growth, the cost of servicing the debt will fall as a proportion of GDP, and the debt burden will fall as growth picks up”

Peter King, CEO, Westpac Banking Corporation

Commercial & Industrial Property

“There’s no comeback on warehouses. There’s been record activity level in them throughout the COVID period for the most part. Same with data centres, they are super strong”

Bob Sulentic, CEO, CBRE Group

“You’ll see lots of people returning to the office. We think 80%-plus of that occupancy, if not more, will come back”

Residential Property

“This recovery in housing prices looks set to continue into 2021, so it will be important for housing supply to resume a steady pace given expectation of borders reopening and migration steadily resuming in the next one to two years. Imbalances in supply/demand will exacerbate house prices, resulting in affordability pressures potentially becoming a widespread issue again in the not too distant future”

Susan Lloyd-Hurwitz, CEO, Mirvac Group

“We are currently posting record lending volumes through our network”

James Symond, CEO, Aussie Home Loans